I told them I'd ask you guys.

Anybody got any ideas you can share with them? I know there are some of you that have a lot of fun with club celebrations.

Thanks in advance. They are very excited to hear any ideas or suggestions you might have.

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

We have a club that is celebrating a 25th year anniversary. They asked if we had any suggestions for ideas that would make their meeting a fun celebration.

I told them I'd ask you guys.

Anybody got any ideas you can share with them? I know there are some of you that have a lot of fun with club celebrations.

Thanks in advance. They are very excited to hear any ideas or suggestions you might have.Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

Jack

go to their favorite non Profit and visit them find out what they would do with a check and give them a check for some of their profit over the years like a $1000. It might bring in new members and they would feel great about making money for their favorite charity.

On Tue, Jan 8, 2013 at 9:35 PM, Laurie Frederiksen <laurie@bivio.biz> wrote:

We have a club that is celebrating a 25th year anniversary. They asked if we had any suggestions for ideas that would make their meeting a fun celebration.

I told them I'd ask you guys.

Anybody got any ideas you can share with them? I know there are some of you that have a lot of fun with club celebrations.

Thanks in advance. They are very excited to hear any ideas or suggestions you might have.Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

monumental, we were just looking for a reason to celebrate. began by

planning a visit to a fed reserve bank in okc. as it neared, the

contact person informed us that our scheduled, inflexible date

wouldn't work so we called the investment rep of one of our members,

and asked for a tour of their okc office, and he gave us a fantastic

talk about retirement and estate planning, and then took us out to

lunch! after lunch we had the ultimate tour of the OKC memorial

museum , given by one of our members who is also a national park

ranger, and had been assigned to the bombing memorial for 9 years

prior to moving to our community. we all went in a step van,had some

financial education, and a meaningful , bonding , if sobering lesson

on perspectives. it evolved on its own, by setting a date, committing

to an outing,

Deannie

On Tue, Jan 8, 2013 at 11:46 PM, Jack Ellison <ellisonjack8@gmail.com> wrote:

>

>

> Jack

>

> On Jan 8, 2013, at 8:25 PM, Jack Ellison <ellisonjack8@gmail.com> wrote:

>

> I look at this from an entirely different viewpoint. I would plan a great

> party, dinner, banquet or even, thinking big a cruise paid for out of the

> treasury. Certainly some of the members are charter members and have been

> loyal over the years. An investment club is not set up or has a mission to

> support causes. It is set up to provide investment education, socialization

> and lastly to provide growth in your investment. So after twenty five years

> give yourself a payback for your dedication hard work and loyalty to your

> membership.

> Jack

>

>

> On Jan 8, 2013, at 6:51 PM, Herb Lemcool <hlemcool@gmail.com> wrote:

>

> go to their favorite non Profit and visit them find out what they would do

> with a check and give them a check for some of their profit over the years

> like a $1000. It might bring in new members and they would feel great about

> making money for their favorite charity.

>

>

> On Tue, Jan 8, 2013 at 9:35 PM, Laurie Frederiksen <laurie@bivio.biz> wrote:

>>

>> We have a club that is celebrating a 25th year anniversary. They asked if

>> we had any suggestions for ideas that would make their meeting a fun

>> celebration.

>>

>> I told them I'd ask you guys.

>>

>> Anybody got any ideas you can share with them? I know there are some of

>> you that have a lot of fun with club celebrations.

>>

>> Thanks in advance. They are very excited to hear any ideas or suggestions

>> you might have.

>>

>> Laurie Frederiksen

>> Invest with your friends!

>> www.bivio.com

>>

>> Become our Facebook friend! www.facebook.com/bivio

>> Follow us on twitter! www.twitter.com/bivio

>> Follow Us on Google+

>>

>>

>> Click here to Subscribe to the Club Cafe email list. Click here to

>> Unsubscribe

>

>

--

Deannie Rule

mcrule@cableone.net

580-225-6941/303-0471

We are Sterling Investment Club

located in the western suburbs of Philadelphia. About 26 years ago a

few of us decided we wanted to learn more about investing and had read

about NAIC in Money magazine. We decided to find about 10 women and

get the manual from NAIC and see where we could go from there. We met

for the first time in February 1988. We still have 15 members, four of

them are charter members. We just went over the $200,000 milestone

after suffering many ups and downs with the market but more

importantly we have learned so much about investing, although we know

we always have so much more to learn. In addition we have made life

long friends. Our evening meetings always end up with a wonderful

dessert where we know we could compete with the Beardstown Ladies. We

look forward to our next 25 years.

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

From: club_cafe@bivio.com [mailto:club_cafe@bivio.com] On Behalf Of Laurie Frederiksen

Sent: Thursday, January 10, 2013 9:52 AM

To: club_cafe@bivio.com

Subject: Re: [club_cafe] Here's a Fun Question

We are Sterling Investment Club

located in the western suburbs of Philadelphia. About 26 years ago a

few of us decided we wanted to learn more about investing and had read

about NAIC in Money magazine. We decided to find about 10 women and

get the manual from NAIC and see where we could go from there. We met

for the first time in February 1988. We still have 15 members, four of

them are charter members. We just went over the $200,000 milestone

after suffering many ups and downs with the market but more

importantly we have learned so much about investing, although we know

we always have so much more to learn. In addition we have made life

long friends. Our evening meetings always end up with a wonderful

dessert where we know we could compete with the Beardstown Ladies. We

look forward to our next 25 years.

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

Personally I find it hard to make 5 year predictions about Apple. I prefer to make judgements about sales growth, net margin and P/E for the next year. I use that to calculate a price I think would be possible within a years time and then compare it to the current price to determine if I think it's a buying opportunity.

There is a lot of big money causing wild swings in Apples price. Fine if you want to trade options, but unnerving if you just want to buy and hold. I think the price will finally settle out where the fundamentals say it should be.

I'm also thinking they might have a boost to their earnings in this next quarterly report because of the reinstatement of the R&D tax credit. They can take the whole years worth retroactively in this quarter and it wasn't taken in the comparable quarter last year.

Of course, these are just some things I personally have been thinking about. If I had a crystal ball it would be a lot easier. Everyone has to make their own judgements as they choose their investments.

Anybody else have any thoughts from their club discussions to share?

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

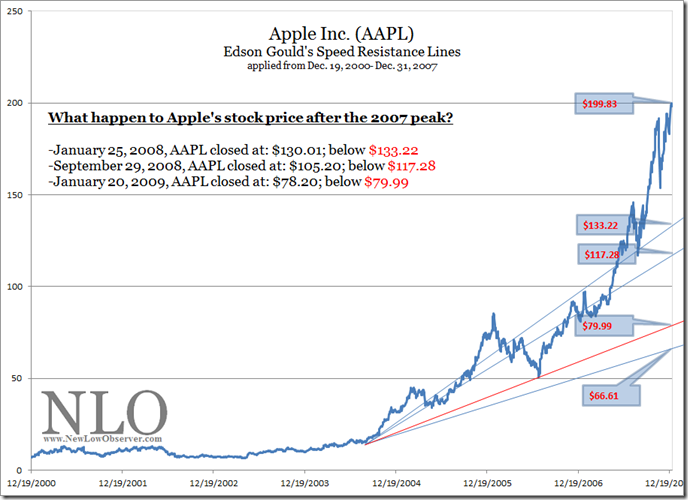

What stands out is the fact that Apple (AAPL) has declined significantly below the $530 support level (red arrows) that was initially established, retested and then violated to the downside. All that seems to remain on the downside, before the next support level, is at the $422 range.

The current price action suggests that there is a lot further to go on the downside. And while $312.53 seems inconceivable, it should be pointed out that this exact downside target (relative to the prior peak) was achieved in the last major run-up on the stock from 2000 to 2007 (the last 7 year run-up in AAPL) at $117.28, as presented in the chart below.

Another factor to consider, in the period from 2000-2007, is the percentage increase in Apple's stock price compared to the current run-up, as indicated below:

- 12/19/2000-12/31/2007: +2,300.67%

- 9/7/2005-9/21/2012: +1,361.28%

If we were to ask the question of what was the likelihood of Apple falling to $133.22 on December 31, 2007, we believe the chorus of Apple investors would say, "not likely, if ever." Similarly, we believe that, based on the current speed resistance lines, no one would expect Apple to decline to our conservative downside target of $312.53, let alone falling to the $235.02 extreme downside target.

While projecting current estimates into the future, AAPL seems to have a bright outlook. However, the current fundamental estimates have not taken into consideration the worst case scenario or legitimate downside risk. We've outlined the deceptive nature of certain fundamental attributes like low P/E ratios, in our article titled "P-E Ratios: Lessons From Conflicting Indications" (found here) from 1905 to the present, which, at times, can be contrary indications. It may be possible that Apple's prospects and fundamentals are merely reflective is ex-poste analysis that was acutely bias to AAPL rising to varying degrees but not falling by a significant amount.

We would not be surprised to see AAPL decline to the $422 level before a substantive rebound (retest of prior highs) were to ensue.

Who is Edson Gould?

"Edson Gould spent over 60 years working in and studying financial markets. Gould studied the arts at Princeton, engineering at Lehigh (from where he graduated in 1922), and finance at New York University. In 1922, after working for a short time at Western Electric, he joined Moody's Investor Service as an analyst and later was editor of Moody's Stock Survey, Bond Survey, and Advisory Reports. In 1948, he began at Arthur Wiesenberger & Company, where he developed and edited the well-known Wiesenberger Investment Report and became a senior partner. He also was Research Director at E. B. Smith (which later became Smith Barney), and worked for Nuveen."

(source: Market Technicians Association. Gould, Edson Beers, Knowledge Base. Accessed April 26, 2012. link MTA reference.)

"Market technician Edson Gould always laughed at the idea of having a significant influence on the stock market, but his predictions were the most precise around. He pinpointed major bull markets and prophesied bottom-out markets as if he had his own peephole into the future. But in place of a crystal ball and wacky off-the-cuff schemes, his were smart, intensely researched and time-tested theories that made him a legend in the investment community."

(source: Fisher, Kenneth L.. 100 Minds That Made the Market. Business Classics, Woodside, CA. 1993. page 320.)

Best Regards.

Toucalit Benton

Dear Amy,

Personally I find it hard to make 5 year predictions about Apple. I prefer to make judgements about sales growth, net margin and P/E for the next year. I use that to calculate a price I think would be possible within a years time and then compare it to the current price to determine if I think it's a buying opportunity.

There is a lot of big money causing wild swings in Apples price. Fine if you want to trade options, but unnerving if you just want to buy and hold. I think the price will finally settle out where the fundamentals say it should be.

I'm also thinking they might have a boost to their earnings in this next quarterly report because of the reinstatement of the R&D tax credit. They can take the whole years worth retroactively in this quarter and it wasn't taken in the comparable quarter last year.

Of course, these are just some things I personally have been thinking about. If I had a crystal ball it would be a lot easier. Everyone has to make their own judgements as they choose their investments.

Anybody else have any thoughts from their club discussions to share?

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+