Parameter of the Week-Short Interest Ratio

There are lots of things investors use to try and give them an edge on choosing stocks. One of them is called the Short Interest Ratio. You might find it an interesting exercise in your investment club meetings to take a look at it for stocks you might be considering purchasing or selling.

Short Interest Ratio is used to try and gauge the general market sentiment about a stocks price. It gives you some feedback on whether the market thinks the price will be going up or down in the near term.

A short seller sells shares of stock he doesn't own. Sooner or later he has to buy back those shares to cover his position. He hopes the price will go down and he can buy them back at a lower price. He is betting on the price of a stock falling. The Short Interest Ratio is the percentage of short sales divided by the average trading volume. If it is high, it indicates there is pessimism about a stocks current price. If it is low, it indicates optimism.

You can find the short interest ratio number for a stock if you go to finance.yahoo.com, type in a ticker and select "Key Statistics" from the menu on the left side of the page that comes up.

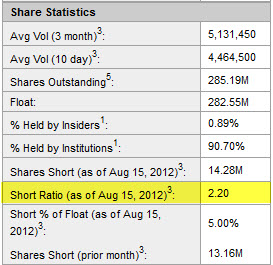

You'll see a box like this toward the bottom right of the Key Statistics page:

This is an example from the Coach (COH) page. I looked at it because my club voted to purchase some at our meeting last night. As you can see the short ratio is 2.20.

The short ratio for Apple (AAPL) is 1.00, for Qualcom (QCOM), (another stock my club voted to purchase), it's 1.50, for Quality Systems (QSII), it's 2.00 and for Bio Reference Labs (BRLI), it's 39.7.

It's interesting to compare them. Obviously, this is not the be all and end all parameter that will tell you what purchase or sell decision to make. But, it might help you time that purchase or sale decision a bit better. If you are going to invest in a company, it is something that you might want to keep an eye on. It's all part of getting to know your investments better.

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

Short Interest Ratio is used to try and gauge the general market sentiment about a stocks price. It gives you some feedback on whether the market thinks the price will be going up or down in the near term.

A short seller sells shares of stock he doesn't own. Sooner or later he has to buy back those shares to cover his position. He hopes the price will go down and he can buy them back at a lower price. He is betting on the price of a stock falling. The Short Interest Ratio is the percentage of short sales divided by the average trading volume. If it is high, it indicates there is pessimism about a stocks current price. If it is low, it indicates optimism.

You can find the short interest ratio number for a stock if you go to finance.yahoo.com, type in a ticker and select "Key Statistics" from the menu on the left side of the page that comes up.

You'll see a box like this toward the bottom right of the Key Statistics page:

This is an example from the Coach (COH) page. I looked at it because my club voted to purchase some at our meeting last night. As you can see the short ratio is 2.20.

The short ratio for Apple (AAPL) is 1.00, for Qualcom (QCOM), (another stock my club voted to purchase), it's 1.50, for Quality Systems (QSII), it's 2.00 and for Bio Reference Labs (BRLI), it's 39.7.

It's interesting to compare them. Obviously, this is not the be all and end all parameter that will tell you what purchase or sell decision to make. But, it might help you time that purchase or sale decision a bit better. If you are going to invest in a company, it is something that you might want to keep an eye on. It's all part of getting to know your investments better.

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe