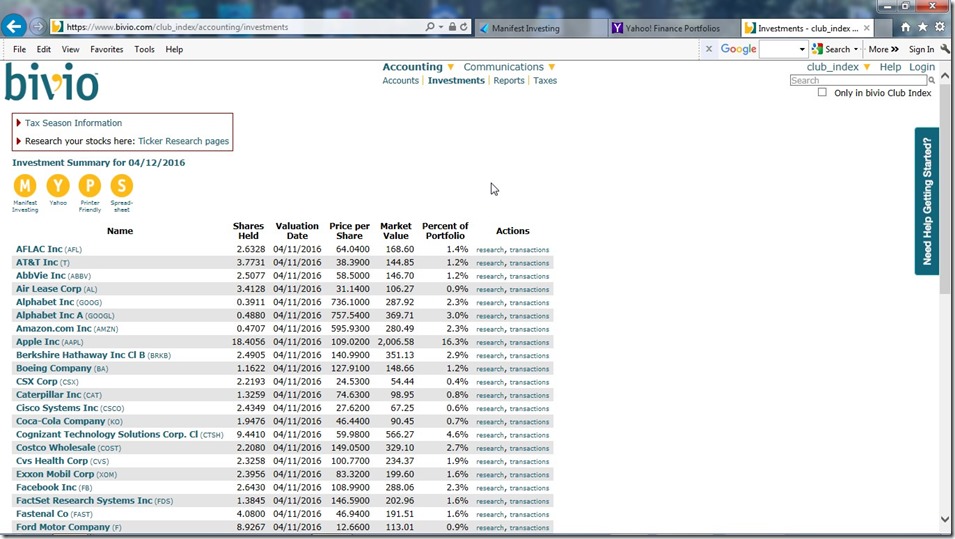

I am going to take a wild guess and say the shares held is related to the percent of the holdings in the clubs. If you add up all the shares listed in that column I am guessing they add up to 100. It looks like the shares held times the price per share on that day equals the market value.

SO for every hundred shares of stock held by all the clubs in Bivio, 2.6328 would be Aflac.

I am just taking an educated guess and I don't know if this helps explain it.

Linda

Pointe Players

From: club_cafe@bivio.com [mailto:club_cafe@bivio.com] On Behalf Of Dick Lewis

Sent: Tuesday, April 12, 2016 6:09 PM

To: club_cafe@bivio.com

Subject: [club_cafe] Re: Bivio Top Club Holdings

Laurie,

I have a question about the Shares Held column in the listing of the Top Club Holdings. For instance..... AFLAC Inc. is shown as 2.6328. I don't understand what this number means. It can't possibly mean that there are 2.6328 shares held by all clubs using Bivio. I couldn't find anything on this page that defines all the column headings.

Please clarify.

Thanks,

Dick

| Virus-free. www.avast.com |

|

|

I am going to take a wild guess and say the shares held is related to the percent of the holdings in the clubs. If you add up all the shares listed in that column I am guessing they add up to 100. It looks like the shares held times the price per share on that day equals the market value.

SO for every hundred shares of stock held by all the clubs in Bivio, 2.6328 would be Aflac.

I am just taking an educated guess and I don't know if this helps explain it.

Linda

Pointe Players

From: club_cafe@bivio.com

[mailto:club_cafe@bivio.com] On Behalf Of Dick Lewis

Sent:

Tuesday, April 12, 2016 6:09 PM

To:

club_cafe@bivio.com

Subject: [club_cafe] Re: Bivio Top Club

Holdings

Laurie,

I have a question about the Shares Held column in the listing of the Top Club Holdings. For instance..... AFLAC Inc. is shown as 2.6328. I don't understand what this number means. It can't possibly mean that there are 2.6328 shares held by all clubs using Bivio. I couldn't find anything on this page that defines all the column headings.

Please clarify.

Thanks,

Dick

| Virus-free. www.avast.com |

On Apr 13, 2016, at 6:24 PM, Dick Lewis <rlewis21@nc.rr.com> wrote:Thanks. I read it...... more than once...... but still don't understand the shares held column. <wlEmoticon-sadsmile[1].png>DickFrom: Laurie FrederiksenSent: Wednesday, April 13, 2016 9:10 AMTo: The Club CafeSubject: Re: [club_cafe] Re: Bivio Top Club Holdings

This describes how the bivio Club Index works:

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

Roy Chastain

"There is nothing on this earth more to be prized than true friendship." Thomas Aquinas

On Apr 13, 2016, at 6:24 PM, Dick Lewis <rlewis21@nc.rr.com> wrote:Thanks. I read it...... more than once...... but still don't understand the shares held column. <wlEmoticon-sadsmile[1].png>DickFrom: Laurie FrederiksenSent: Wednesday, April 13, 2016 9:10 AMTo: The Club CafeSubject: Re: [club_cafe] Re: Bivio Top Club Holdings

This describes how the bivio Club Index works:

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

the creation of the benchmark index 15 + years ago, and

updated daily, provides me the means to evaluate whether my

club's stock selection is equal to, worse, or better than

other bivio clubs' selections. I need more clearly written

information not just about the creation of the index, but

how to use it, and an explanation of the "so what". The top

50 I get. I clicked on the top 50 put in a spreadsheet and

got 143 rows/stocks w 50 updated as of today of the 143, so

the index has 143 stocks. How is that number selected?

which means the top 50 change every day? And that enables

me to compare what criteria how exactly? Clear as mud.

|

|