Earn Some Extra Income On Your Cash Selling Cash Secured Puts

At the last COOL Club meeting, a Cash Secured Put on Coach was sold for $1.25 in the Virtual Trading Simulator. Have you ever been interested in learning why you might do this?

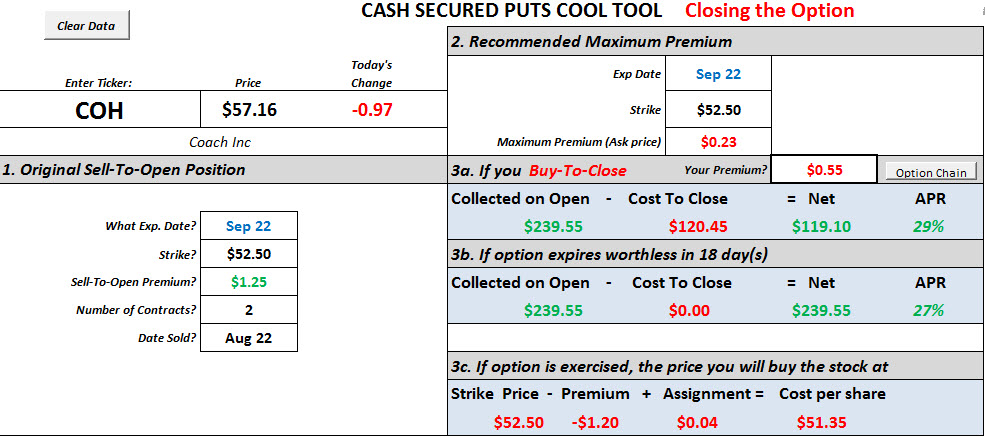

As of a few minutes ago, the status of this trade can be seen below:

As you can see in section 3a of this COOL TOOL Screen shot, we could buy back the option today for $.55, meaning we would have earned $119.10 on the cash we have available to buy COH in a little less than 2 weeks. It is as if we have found a CD paying a 29% interest rate to hold our cash for this time.

In section 3B, you can see that If we don't buy the option back and the price of COH stays above $52.50 until the option expires on Sept. 22, we will earn $239.55 on our cash. Equivalent to a CD with an APR of 27% for the time we held the option.

The "worst" that can happen is that the price of COH falls and ends up below $52.50 on the option expiration date. In that case, COH will be "Put" to us (we will buy it), for a net cost of $51.35 per share. Since we had determined when we sold the Put that we would be glad to own COH if we could purchase it at that price, we will be happy with this scenario also.

If you want to learn more about how this all works, and how you can use the COOL TOOL to make your own Cash Secured Put selections, join us for the weekly COOL Club (Covered Options Online Learing Club) sessions.

Register Now For the September Meetings

If you want to learn more about the COH trade, the recording from the August 22 session is now available here:

COOL Club Recordings

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

As of a few minutes ago, the status of this trade can be seen below:

As you can see in section 3a of this COOL TOOL Screen shot, we could buy back the option today for $.55, meaning we would have earned $119.10 on the cash we have available to buy COH in a little less than 2 weeks. It is as if we have found a CD paying a 29% interest rate to hold our cash for this time.

In section 3B, you can see that If we don't buy the option back and the price of COH stays above $52.50 until the option expires on Sept. 22, we will earn $239.55 on our cash. Equivalent to a CD with an APR of 27% for the time we held the option.

The "worst" that can happen is that the price of COH falls and ends up below $52.50 on the option expiration date. In that case, COH will be "Put" to us (we will buy it), for a net cost of $51.35 per share. Since we had determined when we sold the Put that we would be glad to own COH if we could purchase it at that price, we will be happy with this scenario also.

If you want to learn more about how this all works, and how you can use the COOL TOOL to make your own Cash Secured Put selections, join us for the weekly COOL Club (Covered Options Online Learing Club) sessions.

Register Now For the September Meetings

If you want to learn more about the COH trade, the recording from the August 22 session is now available here:

COOL Club Recordings

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe

Great example & explanation - thanks for walking us through each scenario. Like the CD comparison.

On Sep 4, 2012, at 11:25 AM, Laurie Frederiksen wrote:

At the last COOL Club meeting, a Cash Secured Put on Coach was sold for $1.25 in the Virtual Trading Simulator. Have you ever been interested in learning why you might do this?

As of a few minutes ago, the status of this trade can be seen below:

<StatusofCoachTradeSept42012.jpg>

As you can see in section 3a of this COOL TOOL Screen shot, we could buy back the option today for $.55, meaning we would have earned $119.10 on the cash we have available to buy COH in a little less than 2 weeks. It is as if we have found a CD paying a 29% interest rate to hold our cash for this time.

In section 3B, you can see that If we don't buy the option back and the price of COH stays above $52.50 until the option expires on Sept. 22, we will earn $239.55 on our cash. Equivalent to a CD with an APR of 27% for the time we held the option.

The "worst" that can happen is that the price of COH falls and ends up below $52.50 on the option expiration date. In that case, COH will be "Put" to us (we will buy it), for a net cost of $51.35 per share. Since we had determined when we sold the Put that we would be glad to own COH if we could purchase it at that price, we will be happy with this scenario also.

If you want to learn more about how this all works, and how you can use the COOL TOOL to make your own Cash Secured Put selections, join us for the weekly COOL Club (Covered Options Online Learing Club) sessions.

Register Now For the September Meetings

If you want to learn more about the COH trade, the recording from the August 22 session is now available here:

COOL Club Recordings

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Click here to Subscribe to the Club Cafe email list. Click here to Unsubscribe