In preparation for tonight's COOL_Club session on Selling Covered Options on Index ETFs, I went back and made a couple small changes to the Index ETF COOL Tool. The new version, 2.12, has been posted to the Resources Page of COOL_Club at the following link https://www.bivio.com/cool_club/file/Public/Cool_Club_References.html

Based on just one day of trading, it would appear that the election has brought more volatility into our market again. Market corrections like today's (and it may not be over) provide us all with opportunities to buy at lower prices and/or better valuations. Selling Cash-Secured PUTs is one way to play the "buy-side" of the market. This is not only true for individual stocks but is also true for the Broad Market Index ETFs which we will revisit tonight.

Glad our meetings are going again and I hope you will be able to join us.

Sorry to miss the meeting this afternoon - I live in one of the white areas of the internet and cell coverage... What did I miss? Uh, who bled the market? Got to be a "buy the rumor, sell the fact" or are we just getting beat up because the payola didn't come through?

Can we sell options now that the crisis of earnings and the election are over? Any more "events" we should be considering when we look into trading? Couple of holidays on the Judeo Christian side of the globe and I know China is going into its annual migration season too.

Did the homework get graded?

Malcolm

COOL_Clubbies,

In preparation for tonight's COOL_Club session on Selling Covered Options on Index ETFs, I went back and made a couple small changes to the Index ETF COOL Tool. The new version, 2.12, has been posted to the Resources Page of COOL_Club at the following link https://www.bivio.com/cool_club/file/Public/Cool_Club_References.html

Based on just one day of trading, it would appear that the election has brought more volatility into our market again. Market corrections like today's (and it may not be over) provide us all with opportunities to buy at lower prices and/or better valuations. Selling Cash-Secured PUTs is one way to play the "buy-side" of the market. This is not only true for individual stocks but is also true for the Broad Market Index ETFs which we will revisit tonight.

Glad our meetings are going again and I hope you will be able to join us.

Paul Madison

I missed today's COOL CLUB meeting too - I thought I could get home from work sooner, but it was after 6 and over before I knew it! Darn it. The news on the market said today's sell off was worrying about Greece again, and also with the elections over, nothing changing, and taxes likely going up, therefore I think I'll sell and sit on the sidelines until I see what happens. So, there you go. I think we'll see more down days before it's all said and done......

From: cool_club@bivio.com [mailto:cool_club@bivio.com] On Behalf Of Malcolm Myles

Sent: Wednesday, November 07, 2012 8:19 PM

To: cool_club@bivio.com

Subject: Re: [cool_club] New version of the Index ETF COOL Tool

Man we need to work on that group identity... Clubbies? All I could think of was Annette Funicello in a white turtleneck with Mouse Ears... not bad a bad mental image, but not stocks and options either.

Sorry to miss the meeting this afternoon - I live in one of the white areas of the internet and cell coverage... What did I miss? Uh, who bled the market? Got to be a "buy the rumor, sell the fact" or are we just getting beat up because the payola didn't come through?

Can we sell options now that the crisis of earnings and the election are over? Any more "events" we should be considering when we look into trading? Couple of holidays on the Judeo Christian side of the globe and I know China is going into its annual migration season too.

Did the homework get graded?

Malcolm

On 11/7/2012 11:09 AM, Paul Madison wrote:

COOL_Clubbies,

In preparation for tonight's COOL_Club session on Selling Covered Options on Index ETFs, I went back and made a couple small changes to the Index ETF COOL Tool. The new version, 2.12, has been posted to the Resources Page of COOL_Club at the following link https://www.bivio.com/cool_club/file/Public/Cool_Club_References.html

Based on just one day of trading, it would appear that the election has brought more volatility into our market again. Market corrections like today's (and it may not be over) provide us all with opportunities to buy at lower prices and/or better valuations. Selling Cash-Secured PUTs is one way to play the "buy-side" of the market. This is not only true for individual stocks but is also true for the Broad Market Index ETFs which we will revisit tonight.

Glad our meetings are going again and I hope you will be able to join us.Paul Madison

Man we need to work on that group identity... Clubbies? All I could think of was Annette Funicello in a white turtleneck with Mouse Ears... not bad a bad mental image, but not stocks and options either.

Sorry to miss the meeting this afternoon - I live in one of the white areas of the internet and cell coverage... What did I miss? Uh, who bled the market? Got to be a "buy the rumor, sell the fact" or are we just getting beat up because the payola didn't come through?

Can we sell options now that the crisis of earnings and the election are over? Any more "events" we should be considering when we look into trading? Couple of holidays on the Judeo Christian side of the globe and I know China is going into its annual migration season too.

Did the homework get graded?

Malcolm

On 11/7/2012 11:09 AM, Paul Madison wrote:

COOL_Clubbies,

In preparation for tonight's COOL_Club session on Selling Covered Options on Index ETFs, I went back and made a couple small changes to the Index ETF COOL Tool. The new version, 2.12, has been posted to the Resources Page of COOL_Club at the following link https://www.bivio.com/cool_club/file/Public/Cool_Club_References.html

Based on just one day of trading, it would appear that the election has brought more volatility into our market again. Market corrections like today's (and it may not be over) provide us all with opportunities to buy at lower prices and/or better valuations. Selling Cash-Secured PUTs is one way to play the "buy-side" of the market. This is not only true for individual stocks but is also true for the Broad Market Index ETFs which we will revisit tonight.

Glad our meetings are going again and I hope you will be able to join us.

Paul Madison

Malcolm

PS Feeling gone... (* in millions) replace by irrational exuberance!

PPS I know, I know, he made billions to my hundredaire earnings, but the dude lost $534,000,000 in put options... should we invite him to join COOL Tools?

http://www.businessinsider.com/warren-buffett-derivatives-financial-weapons-of-mass-destruction-2012-11

Hi Malcolm,

Maybe Paul meant to say Cool Dudes and Dudettes... <grin> ...but, if we are "Clubbies", so be it: grab those mouse ears!

You've been terrific at reporting back your homework assignments, and you'll get to hear Paul's gratitude for your homework replies and the other posts you've written on the Cool Club discussion list when you review today's recording.

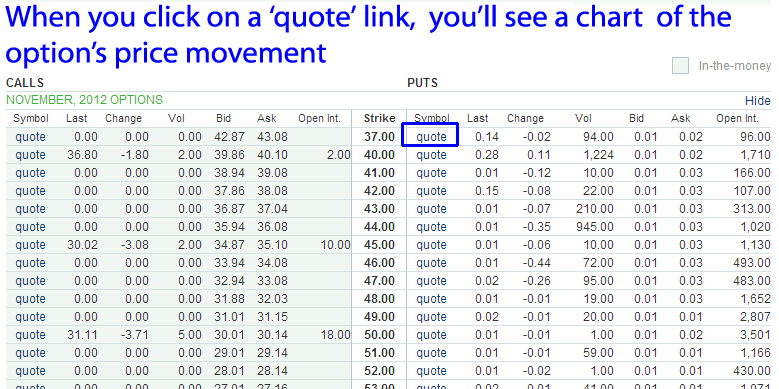

One sneak-peak from today's presentation will show you how to find a price chart for an option. Here's how:

Look up an option chain at MarketWatch.com.

Example price chart: http://www.marketwatch.com/investing/fund/IWM/option/IWMW17124780000

Here's the new homework assignment: report back to the Cool-Club discussion list about any broad-market ETF puts that you sell, along with your thought processes for doing so.

I'll leave it to the Cool Dude to explain the rest.

Sharon

On Wed, Nov 7, 2012 at 7:18 PM, Malcolm Myles <malcolm@mmyles.com> wrote:

Man we need to work on that group identity... Clubbies? All I could think of was Annette Funicello in a white turtleneck with Mouse Ears... not bad a bad mental image, but not stocks and options either.

Sorry to miss the meeting this afternoon - I live in one of the white areas of the internet and cell coverage... What did I miss? Uh, who bled the market? Got to be a "buy the rumor, sell the fact" or are we just getting beat up because the payola didn't come through?

Can we sell options now that the crisis of earnings and the election are over? Any more "events" we should be considering when we look into trading? Couple of holidays on the Judeo Christian side of the globe and I know China is going into its annual migration season too.

Did the homework get graded?

Malcolm

On 11/7/2012 11:09 AM, Paul Madison wrote:

COOL_Clubbies,

In preparation for tonight's COOL_Club session on Selling Covered Options on Index ETFs, I went back and made a couple small changes to the Index ETF COOL Tool. The new version, 2.12, has been posted to the Resources Page of COOL_Club at the following link https://www.bivio.com/cool_club/file/Public/Cool_Club_References.html

Based on just one day of trading, it would appear that the election has brought more volatility into our market again. Market corrections like today's (and it may not be over) provide us all with opportunities to buy at lower prices and/or better valuations. Selling Cash-Secured PUTs is one way to play the "buy-side" of the market. This is not only true for individual stocks but is also true for the Broad Market Index ETFs which we will revisit tonight.

Glad our meetings are going again and I hope you will be able to join us.

Paul Madison