covered call IQNT

This is probably a dumb question and not a good stock for option example. I However I have a losing position in IQNT and have attached the options for Nov. I realize it is thinly traded especially after tanking. I am looking to make the best of a bad situation or a least learn.

Virginia

Virginia

Hi Virginia,

Without knowing anything else about your positions, I would refer to the guideline:

Cut your losses quickly and let your winners run.

Sorry, but the lesson has already been delivered in August.

However, you do hold ownership on a company that has $3.53/share liquid cash, zero debt and is trading at $2.72/share. My second thought would be to investigate why Mr. Market is all poopoo caca on this company. Why have the earnings tank so significantly since March? Why do they have so much cash? Why is management not providing the necessary guidance for the company.

What happened in August when it fell below its Moving Averages and never came back?

Rule to remember:

Trading in Conservative Options is NOT a good method to make a bad situation better.

Malcolm

Without knowing anything else about your positions, I would refer to the guideline:

Cut your losses quickly and let your winners run.

Sorry, but the lesson has already been delivered in August.

However, you do hold ownership on a company that has $3.53/share liquid cash, zero debt and is trading at $2.72/share. My second thought would be to investigate why Mr. Market is all poopoo caca on this company. Why have the earnings tank so significantly since March? Why do they have so much cash? Why is management not providing the necessary guidance for the company.

What happened in August when it fell below its Moving Averages and never came back?

Rule to remember:

Trading in Conservative Options is NOT a good method to make a bad situation better.

Malcolm

On 11/13/2012 9:26 AM, Virginia K

wrote:

This is probably a dumb question and not a good stock for option example. I However I have a losing position in IQNT and have attached the options for Nov. I realize it is thinly traded especially after tanking. I am looking to make the best of a bad situation or a least learn.

Virginia

Hi Virginia,

I have always believed there are no dumb questions only dumb answers and I will try my best not to provide one of those.

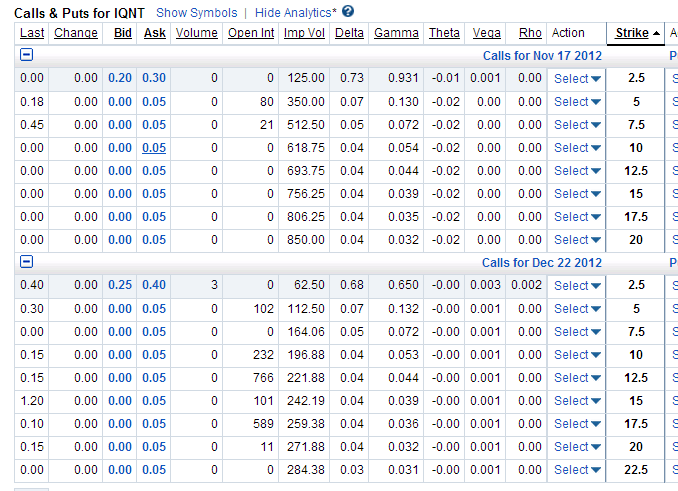

Often stocks that trade in the single digits do not have a lot of option activity and that appears to be the case for IQNT. Looking right now the only CALLs for either Nov or Dec expiration that have any bid activity are at the $2.5 strike and the bids do nothing more than barely cover the intrinsic amount (market price less strike or 2.69 -2.50). (See chart below)

As it sounded like you guessed, it does not look like options are going to provide much value for you.

I do not know anything about Neutral Tandem (maybe somebody else knows about it and wants to comment) but I have found in my own experience that once a stock drops below $10 it may well be in trouble and may be heading for bankruptcy.

I personally have owned a half dozen or so companies that did go bankrupt. It is often hard to jump off the train (as you know it will be painful) because you are sure they are going to turn it around before they get to the cliff.

Sometimes it is best to swallow our pride take what we have left and move on. The best learning is around trying to understand what you might have missed when you bought the company. Although some things happen that are not knowable at the time of purchase and you cannot beat yourself up for those.

For what it is worth, I, as a rule, do not like to buy companies that are less than $10 and I have gotten much better at pulling the trigger and getting out if they fall into that territory.

I have always believed there are no dumb questions only dumb answers and I will try my best not to provide one of those.

Often stocks that trade in the single digits do not have a lot of option activity and that appears to be the case for IQNT. Looking right now the only CALLs for either Nov or Dec expiration that have any bid activity are at the $2.5 strike and the bids do nothing more than barely cover the intrinsic amount (market price less strike or 2.69 -2.50). (See chart below)

As it sounded like you guessed, it does not look like options are going to provide much value for you.

I do not know anything about Neutral Tandem (maybe somebody else knows about it and wants to comment) but I have found in my own experience that once a stock drops below $10 it may well be in trouble and may be heading for bankruptcy.

I personally have owned a half dozen or so companies that did go bankrupt. It is often hard to jump off the train (as you know it will be painful) because you are sure they are going to turn it around before they get to the cliff.

Sometimes it is best to swallow our pride take what we have left and move on. The best learning is around trying to understand what you might have missed when you bought the company. Although some things happen that are not knowable at the time of purchase and you cannot beat yourself up for those.

For what it is worth, I, as a rule, do not like to buy companies that are less than $10 and I have gotten much better at pulling the trigger and getting out if they fall into that territory.

Paul Madison

On Tue, Nov 13, 2012 at 12:26 PM, Virginia K <4gigizmail@gmail.com> wrote:

This is probably a dumb question and not a good stock for option example. I However I have a losing position in IQNT and have attached the options for Nov. I realize it is thinly traded especially after tanking. I am looking to make the best of a bad situation or a least learn.

Virginia

Apparently they paid out all that cash in a special $3 per share dividend on Oct. 31. That is part of the reason for the big price drop.

The report you are looking at is prior to making the dividend payment.

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

On Tue, Nov 13, 2012 at 12:57 PM, Malcolm Myles <malcolm@mmyles.com> wrote:

Hi Virginia,

Without knowing anything else about your positions, I would refer to the guideline:

Cut your losses quickly and let your winners run.

Sorry, but the lesson has already been delivered in August.

However, you do hold ownership on a company that has $3.53/share liquid cash, zero debt and is trading at $2.72/share. My second thought would be to investigate why Mr. Market is all poopoo caca on this company. Why have the earnings tank so significantly since March? Why do they have so much cash? Why is management not providing the necessary guidance for the company.

What happened in August when it fell below its Moving Averages and never came back?

Rule to remember:

Trading in Conservative Options is NOT a good method to make a bad situation better.

Malcolm

On 11/13/2012 9:26 AM, Virginia K wrote:

This is probably a dumb question and not a good stock for option example. I However I have a losing position in IQNT and have attached the options for Nov. I realize it is thinly traded especially after tanking. I am looking to make the best of a bad situation or a least learn.

Virginia