Pretty much explains in a nutshell why we have opportunities to trade options!

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

In my family, Expectations are called Preconceived Disappointments.

So I broke the Golden Rule and took the following position across an Earnings Call:

January 10 STO 6x FAST 13-01-19 47.50 @ 0.50, APR 42%, net $287.30

Current value Bid 0.5 Ask 0.15... I think I'll ride it down.

As a Hero of mine would say... Bangarang!

Malcolm

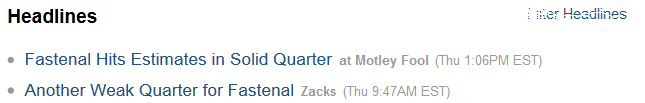

I just noticed these were the two top headlines for FAST on Yahoo Finance:

Pretty much explains in a nutshell why we have opportunities to trade options!

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Upon looking at the FAST 4Q report before the market opened I thought it looked pretty good with sales up 8.5% (helped by higher sales in Dec than the preceding two months) and EPS up 10%. Apparently Mr Market liked this as well since FAST advanced in price until the earnings conference call started at about 10AM ET.

I came away with a couple of negative points from the conference call.

First the CEO indicated sales of "fasteners" were disappointing. He indicated this shortfall was made up by sales in the vending machine are. Since I view fasteners as FAST's bread and butter this did not seem like good news.

Secondly they announced they would be incurring a significant increase in CAPX in 2013 due to the need to expand their facilities to handle the future expected growth. This suggested to me a decline in FCF that I see as important for FAST.

Lastly they voiced disappointment over margins being below expectations.

I have a very high regard for FAST management and have confidence they will address these items and solve them but it may present some pressure on FAST that is priced for perfection with a quite high PE Ratio. Longer term I remain bullish since I see housing making a comeback and the future of advanced manufacturing in the US helping to restore this important part of the US economy.

Dan

On 1/17/2013 2:15 PM, Laurie Frederiksen wrote:

I just noticed these were the two top headlines for FAST on Yahoo Finance:

Pretty much explains in a nutshell why we have opportunities to trade options!

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Oh well, missed it by t h a t much... FAST closed at 48.60 after starting out promisingly, for me at least, below 47. Guess I lost my bet... but wait, what's that you say? I still have my $287 premium AND proceeds from selling 600 of FAST in my tax exempt retirement account. I think I'll have a Sprecher's Ginger Ale (very good if you can find it) and go sun on the patio with the dogs! Probably have to buy them new collars or some cookies when they find out.

Dam I love this game.

Have a Great Weekend!

Malcolm

Everything I read told me FAST was going to do just fine for earnings - it is a solid company, but that the market has already priced in "expectations" beyond just fine.

In my family, Expectations are called Preconceived Disappointments.

So I broke the Golden Rule and took the following position across an Earnings Call:

January 10 STO 6x FAST 13-01-19 47.50 @ 0.50, APR 42%, net $287.30

Current value Bid 0.5 Ask 0.15... I think I'll ride it down.

As a Hero of mine would say... Bangarang!

Malcolm

On 1/17/2013 11:15 AM, Laurie Frederiksen wrote:

I just noticed these were the two top headlines for FAST on Yahoo Finance:

Pretty much explains in a nutshell why we have opportunities to trade options!

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Malcolm that is GREAT success. There will be many other opportunities ahead with your cash!

From: cool_club@bivio.com [mailto:cool_club@bivio.com] On Behalf Of Malcolm Myles

Sent: Friday, January 18, 2013 3:28 PM

To: cool_club@bivio.com

Subject: Re: [cool_club] Don't You Just Love Headlines?

Ring.... Ring.... You've been CALLED!

Oh well, missed it by t h a t much... FAST closed at 48.60 after starting out promisingly, for me at least, below 47. Guess I lost my bet... but wait, what's that you say? I still have my $287 premium AND proceeds from selling 600 of FAST in my tax exempt retirement account. I think I'll have a Sprecher's Ginger Ale (very good if you can find it) and go sun on the patio with the dogs! Probably have to buy them new collars or some cookies when they find out.

Dam I love this game.

Have a Great Weekend!

Malcolm

On 1/17/2013 11:52 AM, Malcolm Myles wrote:

Everything I read told me FAST was going to do just fine for earnings - it is a solid company, but that the market has already priced in "expectations" beyond just fine.

In my family, Expectations are called Preconceived Disappointments.

So I broke the Golden Rule and took the following position across an Earnings Call:

January 10 STO 6x FAST 13-01-19 47.50 @ 0.50, APR 42%, net $287.30

Current value Bid 0.5 Ask 0.15... I think I'll ride it down.

As a Hero of mine would say... Bangarang!

MalcolmOn 1/17/2013 11:15 AM, Laurie Frederiksen wrote:

I just noticed these were the two top headlines for FAST on Yahoo Finance:

Pretty much explains in a nutshell why we have opportunities to trade options!Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+