When one company spins off another in a non-taxable transaction, the basis of the parent company is divided between the two resulting companies. To enter the spinoff, you will need to know the "Remaining Basis Percentage" which is the amount of the original basis that remains with the parent company.

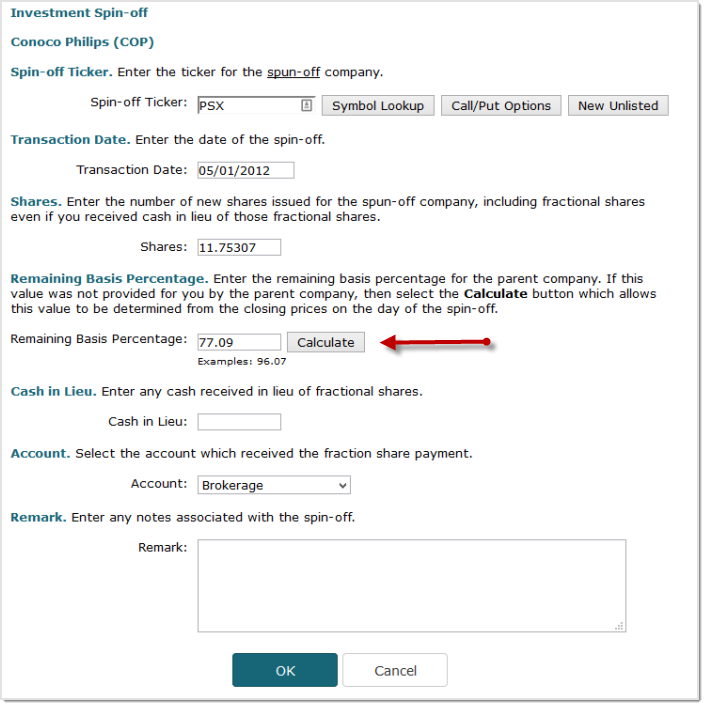

The "Remaining Basis Percentage" is one of the entries you make on the Spinoff Entry form:

There are several acceptable ways to calculate this. Under the new cost basis reporting rules, the company has to provide an example of one of them. They provide this information on a form called an 8937 form. Many brokers use the information provided by the company to allocate basis on their reports.

You can find the 8937 forms for many reorganizations here: Cost Basis Adjustment Documentation.

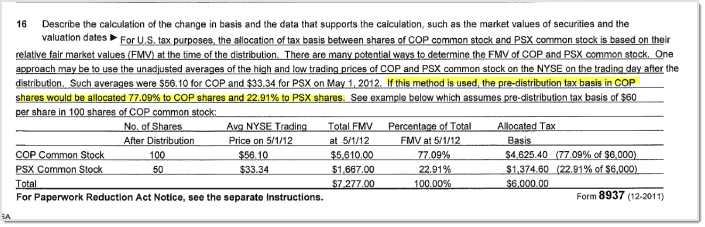

For example, when COP spun off PSX in 2012, they posted this on their website: COP-PSX Spinoff 8937 form

If you read it, you will see that in their example,

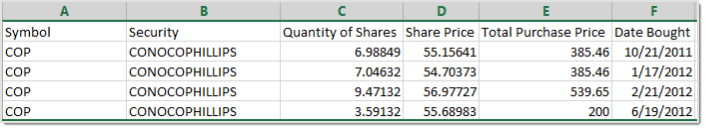

After you have completed entering a spinoff, or if AccountSync has entered it for you, you need to determine whether the cost basis shown in bivio for the two types of shares you now own agrees with what your broker shows. You can do that by comparing these two reports:

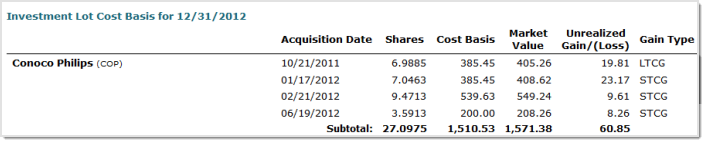

bivio Investment Lot Cost basis Report

An "Unrealized gain/loss" report you can get from your broker

If the cost basis differs between the two reports, it may mean the broker has used a different percentage for the "Remaining Basis Percentage". To adjust bivio to agree with their numbers, just edit the spinoff entry and adjust that amount until you get the cost basis in bivio to agree with what the broker shows.

Related help topics:

More questions? More Help