Filing Your Investment Club Taxes

IRS Form 1065 Instructions

IRS Form 1065 K-1 Instructions

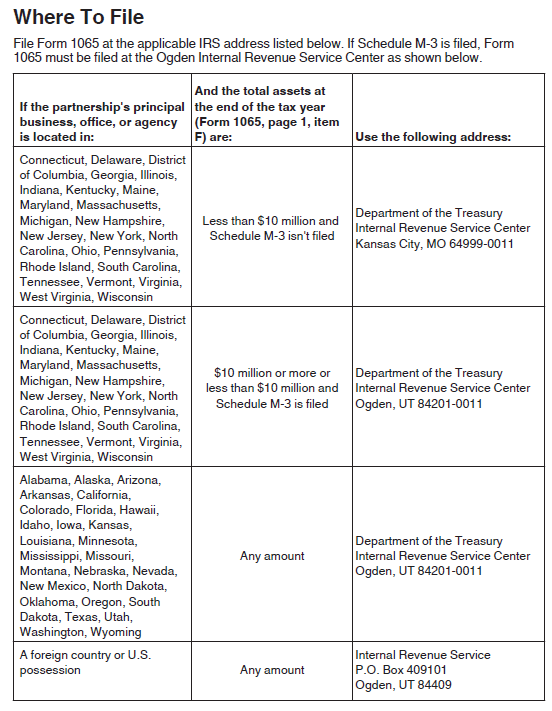

Here is what you need to do to file your investment club tax forms for 2024 by mail.

Make sure to:

- Mail in all the forms included in the "Complete Club Tax Packet". This includes the full 1065 form, all K-1, any K-2 and K-3 forms, and any other schedules or supplemental itemized details included in the packet. You do not need to send in the withdrawal reports at the end of your complete tax packet after the page indicating they don't need to be included.

- Sign the front page of the 1065

- Confirm all member addresses and social security numbers are entered correctly on all K-1 and K-3 forms and Schedule B-2 if they are part of your return.

- Confirm Name, address, phone and Social security number are correct if you have identified a partnership representative at the bottom of page 3 of form 1065.

- Send in forms Certified mail with a return receipt requested.

- Print out a copy for your club files or store a PDF copy in your bivio Files area so you have a way to know in the future exactly what was on the forms you sent in.

- Give members access to their K-1 and K-3 files online by checking the box on the Accounting>Taxes page or give each of them a K-1, K-1 Attachment page, any K-3 and withdrawal reports that pertain to them.