The Unit Value of a club is the same as the Net Asset Value (NAV) of a mutual fund. It is established once each day. It is the total value of all your club assets (cash plus closing price stock values) divided by the number of units outstanding on the day in question. You can think of it as the cost to purchase one share (unit) of your club on a particular date.

Unit value is used to determine the number of units a member payment will purchase or the number of units that will be redeemed when a member withdraws.

Unit Value does not change when members make payments - it only changes as the value of your club assets (cash + stock) change each day. This is because, even though member contributions provide more cash, they also increase the number of units in the club.

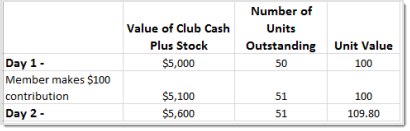

For example, if the value of your club assets on a particular date is $5000 and members own 50 units in total, the value of each unit is $100. If a member contributes $100 he will purchase 1 unit. After the contribution, the value of your club assets will be $5100 and the number of units outstanding will be 51. The unit value will remain at $100.

On the next day, if the value of the stock your club owns goes up by $500, the total value of all your club assets will increase to $5600. If no further member payments have been made, the 51 units that are in your club will now have a unit value of $5600/51 = $109.80.

We use an initial Unit Value of $10 when your club first starts. Once the club is in operation, the Unit Value fluctuates along with the total value of your clubs assets (cash + stock). The initial Unit Value is merely an arbitrary starting point.

You pick which days unit value to use to enter accounting transactions by specifying a valuation date when you enter them. You can find a further discussion of valuation dates here:

More questions? More Help