(LYSDY) that our TDAM 1099 lists as "Gross proceeds". Does

anyone know how to reconcile this in the bivio tax

questionnaire?

You all must be SO busy now. I wish you the best.

|

I have an Undetermined Transaction for Lynas Corporation ADR

(LYSDY) that our TDAM 1099 lists as "Gross proceeds". Does

anyone know how to reconcile this in the bivio tax

questionnaire?

You all must be SO busy now. I wish you the best.

stock split 6-3-2011. Very hard to find out info about this

company as it's Australian ADR (pink sheet?) bivio tax

questionnaire asked me ex-dividend date on this $0.56

("gross proceeds").

|

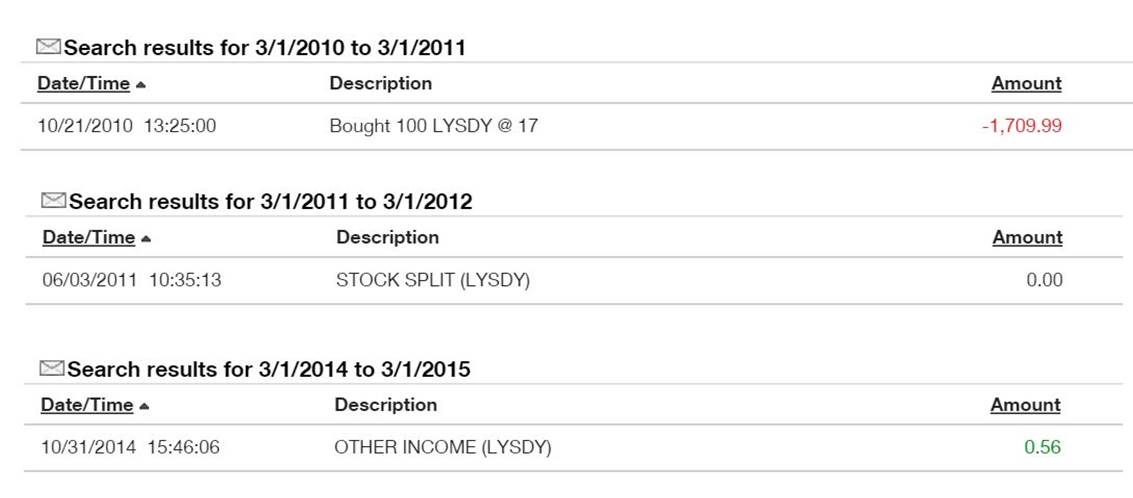

Researched history on TDAM (attached). Looks like this

stock split 6-3-2011. Very hard to find out info about this

company as it's Australian ADR (pink sheet?) bivio tax

questionnaire asked me ex-dividend date on this $0.56

("gross proceeds").

from a Rights Offering... because they are a foreign company

they sell off in their own market and send us the proceeds.

|

I called TDAM about this. They said the $0.56 are proceeds

from a Rights Offering... because they are a foreign company

they sell off in their own market and send us the proceeds.

IRS, and that's it's up to my tax person to determine if

it's short-term or long-term.

|

future request like this to the support email.