Partial withdrawal

Our club has been in existence for many years and some of the member are thinking about making partial withdrawals, one so far is withdrawing $10,000. We will fill out the withdraw form, we have to sell stock to pay her. Is filling out the form is all we have to do, with that information? BIVIO will take care of everything else? Also since we have more members that might be taking partial or all their money out, what do you recommend for us to prepare for this. It will amount to a lot of money. We are also in a situation where about 1/2 of the members have been in for 2 years or less and have very little money at risk, compared to those that have thousands at risk. The newer members are willing to take more risks with stocks and the older members are getting nervous about how the clubs money will be used. Do you have any ideas on how to respond to both the newbies and the oldies?

Our club started allowing members to purchase units from each other, once per year. We do the partial withdrawal for the member who wants to cash out and other (usually newer) members pay them directly so it's a unit transfer. We only do it at the beginning of the year - determine Jan 1 unit price and this allows newer members to increase their stake while simultaneously allowing older members to withdraw without forcing us to sell stocks. Hoping that we're on the up and up!

On Thu, Jan 25, 2018 at 7:55 PM, Diana Evans via bivio.com <user*32774200001@bivio.com> wrote:

Our club has been in existence for many years and some of the member are thinking about making partial withdrawals, one so far is withdrawing $10,000. We will fill out the withdraw form, we have to sell stock to pay her. Is filling out the form is all we have to do, with that information? BIVIO will take care of everything else? Also since we have more members that might be taking partial or all their money out, what do you recommend for us to prepare for this. It will amount to a lot of money. We are also in a situation where about 1/2 of the members have been in for 2 years or less and have very little money at risk, compared to those that have thousands at risk. The newer members are willing to take more risks with stocks and the older members are getting nervous about how the clubs money will be used. Do you have any ideas on how to respond to both the newbies and the oldies?

The most important thing in my mind is that the withdrawals

be handled in accordance with your partnership agreement.

bivio's accounting for partial and full withdrawals is very

straight forward. You may even make a practice withdrawal

and back it out if you want to see how it works. A

withdrawal report will be available after either partial or

complete withdrawal.

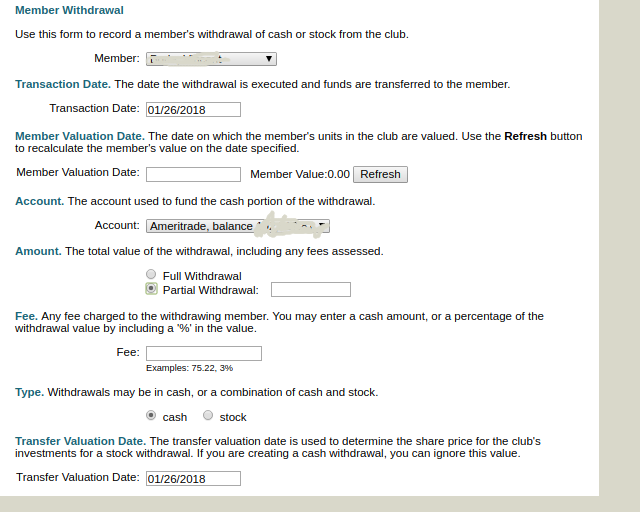

I have attached a screen shot of the withdrawal entry

(redacted).

You will need the valuation date specified by your

partnership agreement and then hit refresh button on the

page to get that partners balance at that date. Just fill in

the amount of the withdrawal and any fee, specifiy cash or

stock and you're done after hitting 'ok'. I hope that helps.

It is unclear to me why partners with less capital interest

pose any risk to those with more unless you have a

partnership agreement that gives each partner an equal vote

rather than a vote based on ownership of the partnership.

regards - s

be handled in accordance with your partnership agreement.

bivio's accounting for partial and full withdrawals is very

straight forward. You may even make a practice withdrawal

and back it out if you want to see how it works. A

withdrawal report will be available after either partial or

complete withdrawal.

I have attached a screen shot of the withdrawal entry

(redacted).

You will need the valuation date specified by your

partnership agreement and then hit refresh button on the

page to get that partners balance at that date. Just fill in

the amount of the withdrawal and any fee, specifiy cash or

stock and you're done after hitting 'ok'. I hope that helps.

It is unclear to me why partners with less capital interest

pose any risk to those with more unless you have a

partnership agreement that gives each partner an equal vote

rather than a vote based on ownership of the partnership.

regards - s

I believe you are in error having members "buy units" from each other. Member withdrawals are one thing. Members purchasing units are a separate, unrelated transaction. Check with Bivio before trying to link these.

The most important thing in my mind is that the withdrawals

be handled in accordance with your partnership agreement.

bivio's accounting for partial and full withdrawals is very

straight forward. You may even make a practice withdrawal

and back it out if you want to see how it works. A

withdrawal report will be available after either partial or

complete withdrawal.

I have attached a screen shot of the withdrawal entry

(redacted).

You will need the valuation date specified by your

partnership agreement and then hit refresh button on the

page to get that partners balance at that date. Just fill in

the amount of the withdrawal and any fee, specifiy cash or

stock and you're done after hitting 'ok'. I hope that helps.

It is unclear to me why partners with less capital interest

pose any risk to those with more unless you have a

partnership agreement that gives each partner an equal vote

rather than a vote based on ownership of the partnership.

regards - s

Our partnership agreement allows for members to purchase

units from another partner that wishes to withdraw but no

one has ever desired to do so.

units from another partner that wishes to withdraw but no

one has ever desired to do so.