We have not filed an AZ return. This is based on ARIZONA Form

165. It states "Note: A partnership that has no Arizona income,

deductions or credits for taxable year 2019 is not rrequired to file

a partnership return for that year".

My take on this is the K-1 information feeds from the Fed return

to the AZ return. If you read it differently please let me know.

480 649 7510

On February 18, 2020 at 5:29 PM "Dorothy Meunier via bivio.com" <user*23103200001@bivio.com> wrote:

I just got this message from our president:"AZ is requiring electronic filing starting with this tax year(?) unless one obtains a waiver. Does BIVIO provide such options and how much?"We have always mailed in our returns. How do we do it electronically?Thanks,Dorothy Meunier

For California taxes, BIVIO included this statement. California is one of few the states that BIVIO includes in the annual fees

eFile Waiver

Submit an eFile waiver using the link below with the information provided prior to, or up to 15 days after, filing your

California return.

https://www.ftb.ca.gov/tax-pros/efile/business-eFile-waiver-request.asp

Entity Information

Entity Type General Partnership

Form Type 565

Waiver Information

Software/Product Used bivio.com

Reason for Waiver Technology Constraints

Explanation

bivio.com is an accounting program for investment club

partnerships. It generates federal and CA partnership returns, but

does not provide e-file capabilities for any returns.

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Dorothy Meunier via bivio.com

Sent: Tuesday, February 18, 2020 2:29 PM

To: The Club Cafe <club_cafe@bivio.com>

Cc: Donna Portz <deeportz@gmail.com>

Subject: [club_cafe] electronic filing

I just got this message from our president:

"AZ is requiring electronic filing starting with this tax year(?) unless one obtains a waiver. Does BIVIO provide such options and how much?

"

We have always mailed in our returns. How do we do it electronically?

Thanks,

Dorothy Meunier

We have not filed an AZ return. This is based on ARIZONA Form

165. It states "Note: A partnership that has no Arizona income,

deductions or credits for taxable year 2019 is not rrequired to file

a partnership return for that year".

My take on this is the K-1 information feeds from the Fed return

to the AZ return. If you read it differently please let me know.

480 649 7510

On February 18, 2020 at 5:29 PM "Dorothy Meunier via bivio.com" <user*23103200001@bivio.com> wrote:

I just got this message from our president:"AZ is requiring electronic filing starting with this tax year(?) unless one obtains a waiver. Does BIVIO provide such options and how much?"We have always mailed in our returns. How do we do it electronically?Thanks,Dorothy Meunier

1. Whether you need to file an AZ return. If the club has

one penny of income from any source, then you need to file

the AZ 165. If your club has not received any income from

any source, then it is still good practice to file the

return in order to start of the statute of limitations on

audits.

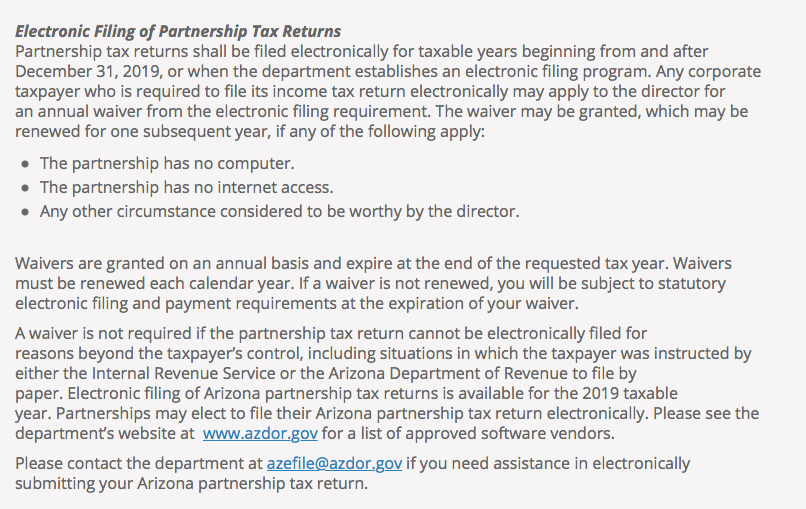

2. Re electronic filing. The requirement is for tax years

after 31 Dec 2019. In other words, the tax return for tax

year 2020 is the first year for the requirement. So you

don't need to worry about it in this filing season.

The instructions say it is possible to have the requirement

waived by petitioning the director.

A member of our club is a high-ranking employee of AZDOR. I

have asked him to explore getting the department to issue a

pre-emptory exemption for partnerships that do not engage in

business, which would cover investment clubs. If adopted, it

would eliminate the requirement for petitioning for an

exemption each year.

Because of the few clubs located in AZ, I doubt that it

would be cost-effective, or you would not like the increase

in annual fees, for bivio to create an e-file option for

AZ.

If the treasurers of AZ-based clubs would identify

themselves to me, I can use the information to organize

further lobbying with AZDOR to create the automatic

exemption.

|

This thread contains two separate topics.

1. Whether you need to file an AZ return. If the club has

one penny of income from any source, then you need to file

the AZ 165. If your club has not received any income from

any source, then it is still good practice to file the

return in order to start of the statute of limitations on

audits.

2. Re electronic filing. The requirement is for tax years

after 31 Dec 2019. In other words, the tax return for tax

year 2020 is the first year for the requirement. So you

don't need to worry about it in this filing season.

The instructions say it is possible to have the requirement

waived by petitioning the director.

A member of our club is a high-ranking employee of AZDOR. I

have asked him to explore getting the department to issue a

pre-emptory exemption for partnerships that do not engage in

business, which would cover investment clubs. If adopted, it

would eliminate the requirement for petitioning for an

exemption each year.

Because of the few clubs located in AZ, I doubt that it

would be cost-effective, or you would not like the increase

in annual fees, for bivio to create an e-file option for

AZ.

If the treasurers of AZ-based clubs would identify

themselves to me, I can use the information to organize

further lobbying with AZDOR to create the automatic

exemption.

If you need an Arizona state return filed electronically, we do offer a very cost effective option for preparing it. They can be done by Ira Smilovitz.

Here is more information:

Laurie Frederiksen

Invest with your friends!

www.bivio.com

Become our Facebook friend! www.facebook.com/bivio

Follow us on twitter! www.twitter.com/bivio

Follow Us on Google+

Click here to Subscribe to the Club Cafe email list. Click here to UnsubscribeOn Tue, Feb 18, 2020 at 7:32 PM John W Ranby Trustee PGM Cariboo Trust via bivio.com <user*15792700001@bivio.com> wrote:This thread contains two separate topics.

1. Whether you need to file an AZ return. If the club has

one penny of income from any source, then you need to file

the AZ 165. If your club has not received any income from

any source, then it is still good practice to file the

return in order to start of the statute of limitations on

audits.

2. Re electronic filing. The requirement is for tax years

after 31 Dec 2019. In other words, the tax return for tax

year 2020 is the first year for the requirement. So you

don't need to worry about it in this filing season.

The instructions say it is possible to have the requirement

waived by petitioning the director.

A member of our club is a high-ranking employee of AZDOR. I

have asked him to explore getting the department to issue a

pre-emptory exemption for partnerships that do not engage in

business, which would cover investment clubs. If adopted, it

would eliminate the requirement for petitioning for an

exemption each year.

Because of the few clubs located in AZ, I doubt that it

would be cost-effective, or you would not like the increase

in annual fees, for bivio to create an e-file option for

AZ.

If the treasurers of AZ-based clubs would identify

themselves to me, I can use the information to organize

further lobbying with AZDOR to create the automatic

exemption.