Hello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more ‘charter members’ who are in their 80’s and may withdraw at any time now. Three charter members hold 70% of the club’s valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC

Hello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more 'charter members' who are in their 80's and may withdraw at any time now. Three charter members hold 70% of the club's valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC

On May 13, 2020, at 7:43 AM, SB via bivio.com <user*1595500001@bivio.com> wrote:Have you considered entering a withdrawal to see the effect and then deleting it afterwards?Hello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more 'charter members' who are in their 80's and may withdraw at any time now. Three charter members hold 70% of the club's valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC

<image001.png>

Hello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more 'charter members' who are in their 80's and may withdraw at any time now. Three charter members hold 70% of the club's valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC

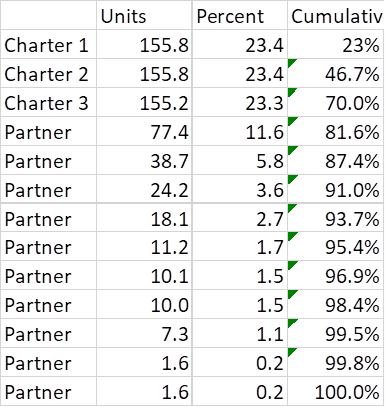

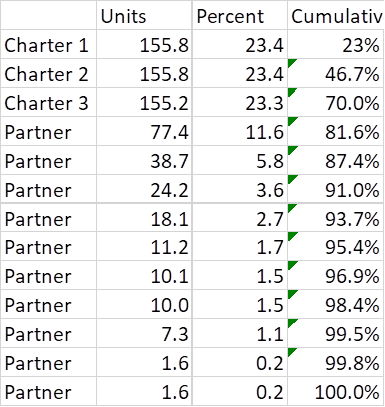

What is the cumulative column representing?Dick LewisGMICFrom: SB via bivio.comSent: Wednesday, May 13, 2020 7:43 AMSubject: Re: [club_cafe] FW: Estimating impact of charter member withdrawalsHave you considered entering a withdrawal to see the effect and then deleting it afterwards?Hello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more 'charter members' who are in their 80's and may withdraw at any time now. Three charter members hold 70% of the club's valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC

Hello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more 'charter members' who are in their 80's and may withdraw at any time now. Three charter members hold 70% of the club's valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC

* there are many withdrawal options, each of which plays out

differently for the club as well as for the member making

a withdrawal

* bivio help has **excellent** information about all of this

in the withdrawals section; there's a lot to study and

understand and it's very worth the time

https://www.bivio.com/site-help/bp/StartPage

* our club has worked hard over the years to find solutions

that are advantageous for everyone and the bivio

information has been invaluable

* speaking as one of the longer - term members of my club, I

hope you are including representation from your senior

members in this discussion

* bearing in mind that everyone's situation is different,

and this may not be an option for your members, I add my

own experience. I recently took a partial withdrawal of

highly appreciated stock from our club in order to reduce

my share of the club relative to others. I did not sell

these shares, but transferred them to charity. This

resulted in no capital gains for the club or for me.

|

You can calculate the CG impact on a withdrawing member by comparing their tax basis to their market value on the Member Status Report. If the difference (MV - TB) is positive, they have a capital gain, if negative, a capital loss.The withdrawal itself has no impact on the remaining members. What can affect the remaining members is what actions you take to fund the withdrawal. The best option is to transfer highly appreciated stock to the withdrawing member. This locks in each remaining member's share of the unrealized capital gain and defers the tax recognition of that gain until the date that member withdraws from the club. Another useful tactic is to review the club's portfolio and sell any losers that don't meet the club's investment strategy to raise cash for the withdrawal. This provides a current year capital loss for all of the members. What you don't want to do is sell gains or transfer shares at a loss.Ira SmilovitzHello Bivio Club Cafe members. I need some opinions on a difficult topic. I currently lead our SCS Investment Club (over 20 years old) and am trying to assess the impact of 1 or more 'charter members' who are in their 80's and may withdraw at any time now. Three charter members hold 70% of the club's valuation. Is it possible to simulate the impact of their withdrawals from a capital gains/losses tax standpoint on them and the rest of the members, and what are the guidelines around partial vs complete withdrawals? A response as soon as possible is requested as we have a committee meeting to discuss this topic on Friday May 15.

Thanks in advance for your support.

Norm

Norman C Blizard

SCSIC