What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

Unless there have been new or a new annual report, we try to just give the buy/hold/sell recommendations and any significant company news. We can then go deeper when the time comes to discuss buys and sells. The only exceptions are MY reports which are ALWAYS scintillating, wise, entertaining, and clearly worth hearing in microscopic detail.You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

On 08/15/2020 10:30 AM Stuart Lange via bivio.com <user*25028600001@bivio.com> wrote:

Unless there have been new or a new annual report, we try to just give the buy/hold/sell recommendations and any significant company news. We can then go deeper when the time comes to discuss buys and sells. The only exceptions are MY reports which are ALWAYS scintillating, wise, entertaining, and clearly worth hearing in microscopic detail.

Virus-free. www.avast.com

You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

Partners should NOT be reading from Value Line or Morninstar or CFRA. Buy/Hold/Sell based on an updated SSG of the company is all.My suggestion: This could be a good education topic on what should and should not be in a stock report. Get a group consensus of what is important to know. Create a form (MS Word or MS Excel or on Google Drive). Try it for 3 to 6 months and then come back to the Stock Report and do a 2nd education segment on what is working and what is not working on the stock reports as agreed to by the partners.KevinUnless there have been new or a new annual report, we try to just give the buy/hold/sell recommendations and any significant company news. We can then go deeper when the time comes to discuss buys and sells. The only exceptions are MY reports which are ALWAYS scintillating, wise, entertaining, and clearly worth hearing in microscopic detail.You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

|

Quarter Report

Company Name: Visa (V) Quarter Ending: 6/30/2020 Stock Watcher: MSE |

|

|

1. Quarter Results: What was the % change in sales and EPS over the same quarter last year? What was the % change in the metrics specific to this company. Is the company meeting our expectations on the SSG? If not why not? (The press release or 10Q will provide the % change and some of the metrics. The conference call should provide the rest.) |

Sales $4.8B -17% Net Income $2.4B -24% EPS $1.06 -23%

COVID related transaction volume changes volume drove the quarter Management has withdrawn all guidance

|

|

2. Hot List Items: Hot List Items are positive or negative situations you are watching on this company. Other than Sales & EPS, did this quarter produce anything that would add, update or cause you to delete anything from your current hot list? Are there any positive or negative situations brewing that could affect our return? |

Payment volume dropped 10% Processed transactions dropped 13% Cross boarder volume dropped/ 47% (most profitable transactions)

"In the fiscal third quarter we saw spending improve each month as most countries began to relax domestic restrictions. In the U.S., as the quarter progressed, payments volume meaningfully improved, driven by the relaxing of shelter-in-place restrictions in a number of states. This helped to lift card present spending while eCommerce excluding travel spend remained consistently elevated, as consumers continued to shift their spend online. International markets are at various stages of reopening and recovery, with many large markets having a trajectory comparable to the U.S. Global processed transaction growth has slightly lagged payments volume growth, as the mix of spending shifted away from smaller purchases. Cross-border volume has improved only marginally through the quarter as travel has been heavily affected by most country borders remaining closed, partially offset by strong eCommerce spend excluding travel." |

|

3. Management/Analyst Guidance: Did management give any future guidance for sales or EPS on the conference call? Is there any change in the guidance from Value Line, Yahoo or Morningstar from last quarter? (See Value Line Annual Rates box for sales & Earnings; see Yahoo's 1- and 5-year EPS growth estimates; and read the latest Morningstar analysis for changes.) |

Morningstar - This suggests the impact should diminish significantly going forward, and that the long-term secular tailwinds that have driven Visa's growth historically remain in place... Cross-border volumes are highly tied to travel, and we believe a full bounce back in travel could hinge on the development and widespread availability of a vaccine. Value Line - Transaction volumes will suffer in the near term. During the fiscal third quarter, total dollar volumes in Europe, Latin America, Asia/Pacific, and the segment comprised of Central Europe, the Middle East, and Africa dropped 14.1%, 14.3%, 18.8%, and 13.8%, respectively, from a year ago. The United States and Canada only fared slightly better, with volumes down 6.5% and 12.5%, respectively, in the latest three-month stretch. Travel restrictions, and a shift away from smaller purchases, will weigh on transaction data for the time being. |

|

4. Changes to the SSG: Are there any changes to the company or industry that would cause us to change our judgments? (News alerts and the conference call should shed some light.) List any changes to the SSG that you would recommend to the club, and why. |

Volumes are returning to normal levels, but moving from credit to debit. More emphasis on touchless payment options (tap to pay, Apple Pay, Google Pay, etc.) No short term changes. Wait until a vaccine is available impacting changes on cross boarder volumes . |

|

5. Relevant News: Did anything meaningful come from the conference call, earnings report, or analyst reports or news articles? (Use the back of this form for overflow.) |

Mastercard has reported similar issues.

|

|

Overflow Notes: (Please number them based on sections on page one:

2. "We continue to focus on managing our business for the medium and long-term despite the challenges of the global pandemic. In the quarter, we were pleased to see strong growth in areas that are strategically important, including eCommerce, tap to pay, new flows and value-added services. We remain committed to our strategy and are thoughtfully investing to fuel Visa's future performance." - Alfred Kelly, Jr, CEO

From the Visa 3Q earnings presentation

|

|

You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

I agree, quarterly/annual reports that speak to why management has the numbers they do is very important to have.

That's a good point about not having an SSG all the time. So, if you don't have an SSG or ValueLine/Morningstar what do you think are some important data points to note when you're researching a stock?

I like that form, I'm definitely going to borrow it. Thanks!

I agree, quarterly/annual reports that speak to why management has the numbers they do is very important to have.

That's a good point about not having an SSG all the time. So, if you don't have an SSG or ValueLine/Morningstar what do you think are some important data points to note when you're researching a stock?

There are very few things in VL or M*, other than judgement or opinion, that you can't figure out from the 10K/10Q.Mark EckmanI like that form, I'm definitely going to borrow it. Thanks!

I agree, quarterly/annual reports that speak to why management has the numbers they do is very important to have.

That's a good point about not having an SSG all the time. So, if you don't have an SSG or ValueLine/Morningstar what do you think are some important data points to note when you're researching a stock?--Mark Eckman

|

- The logo helps identify the company is a less boring way than just the name, so that is optional.

- The Sector & Industry, Quality Rating and Projected Return from ManifestInvesting.

- The Narrative from the ValueLine report. OR, the Narrative from the IAS report.

- The Visual Analysis from the SSG

- The SSG Results Summary from the SSG

- The Potential Gain vs Loss chart

- The miniature Visual Analysis is something every BI member can immediately relate to and it tells a story.

- The ManifestInvesting notes give a similar, but independent perspective

- The SSG Summary quickly tells six pieces of important information

- the Potential Gain vs Loss chart is a quick visual that some people can better relate to than the U/D number that is in the Summary.

- The Narrative gives a quick summary of what's going on, and may give hints of why things are not going well and what the future might hold.

- The Gain vs Loss Chart from the SSG.

You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

On Aug 24, 2020, at 9:48 PM, Linda Glein via bivio.com <user*21345500001@bivio.com> wrote:

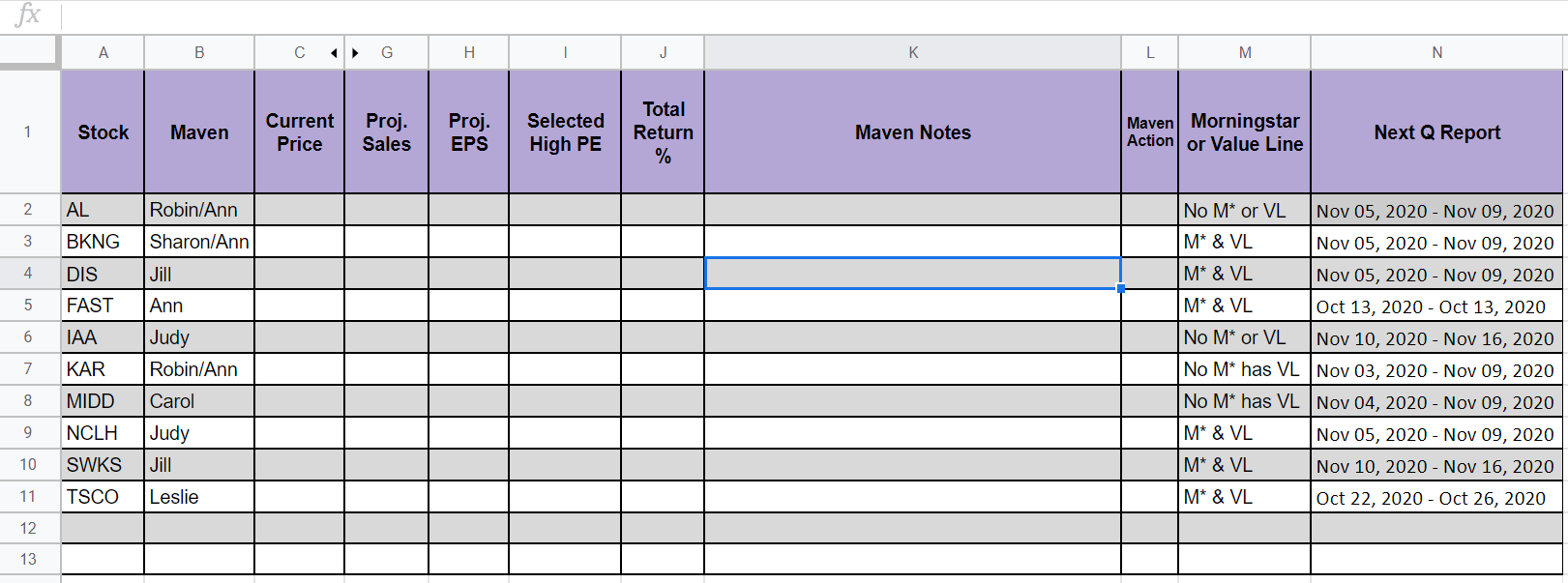

Does your club use visuals? Like using PPT on a screen or TV?Even if you don't, you can hand out a quick report.Here is what I do: (or used to, I got a bit out of the habit, but will start again).<image.png>I would grab (print screen these elements and include them on a one page summary.)

- The logo helps identify the company is a less boring way than just the name, so that is optional.

- The Sector & Industry, Quality Rating and Projected Return from ManifestInvesting.

- The Narrative from the ValueLine report. OR, the Narrative from the IAS report.

- The Visual Analysis from the SSG

- The SSG Results Summary from the SSG

- The Potential Gain vs Loss chart

Okay, why these elements, and why one page?

- The miniature Visual Analysis is something every BI member can immediately relate to and it tells a story.

- The ManifestInvesting notes give a similar, but independent perspective

- The SSG Summary quickly tells six pieces of important information

- the Potential Gain vs Loss chart is a quick visual that some people can better relate to than the U/D number that is in the Summary.

- The Narrative gives a quick summary of what's going on, and may give hints of why things are not going well and what the future might hold.

- The Gain vs Loss Chart from the SSG.

The One page approach gives a quick overview, and makes anything else you might need to say more relevant and interesting. It can be projected on a screen, or printed and handed out. It takes some prep time, but not all that much once you get the hang of it.The LindatopYou know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

Hello. For my club, I use a multipage powerpoint (PPT) as a PDF with screen captures of various datasources not only to better explain but also as a teachable moment. As a retired engineer, I had to communicate a lot using visuals to management and teams. An example is attached. This PDF is projected on a screen in a classroom we use at our Mill Race (Senior) Center monthly. My laptop is the 'driver' for these power points. We are also now using Zoom, remote microphone and camera for whiteboard discussions led by our best and most experienced investor partner. Personally I prefer pictures over prose, I agree can be boring, but probably because I have attention deficit s(ometimes). PPT presentation is few on words but I normally speak over each slide to explain them. I am also looking for a one page summary that is not intimidating to neophyte investors yet permits a good discussion of a stock. We also require a SSG using BI website online tool. However, compliance is sporadic. Comments please. Not saying this is superior to prose or first look, just an alternative (that works for me). I like an approach that reduces this to a one-page standardized format and will consider Linda's.

Thanks Norm

Norman C Blizard

SCS Investment Club Columbus IN

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of cecelia vanderlip via bivio.com

Sent: Monday, August 24, 2020 10:52 PM

To: club_cafe@bivio.com

Subject: Re: [club_cafe] Boring Stock Reports?

I like it!

On Aug 24, 2020, at 9:48 PM, Linda Glein via bivio.com <user*21345500001@bivio.com> wrote:

Does your club use visuals? Like using PPT on a screen or TV?

Even if you don't, you can hand out a quick report.

Here is what I do: (or used to, I got a bit out of the habit, but will start again).

<image.png>

I would grab (print screen these elements and include them on a one page summary.)

- The logo helps identify the company is a less boring way than just the name, so that is optional.

- The Sector & Industry, Quality Rating and Projected Return from ManifestInvesting.

- The Narrative from the ValueLine report. OR, the Narrative from the IAS report.

- The Visual Analysis from the SSG

- The SSG Results Summary from the SSG

- The Potential Gain vs Loss chart

Okay, why these elements, and why one page?

- The miniature Visual Analysis is something every BI member can immediately relate to and it tells a story.

- The ManifestInvesting notes give a similar, but independent perspective

- The SSG Summary quickly tells six pieces of important information

- the Potential Gain vs Loss chart is a quick visual that some people can better relate to than the U/D number that is in the Summary.

- The Narrative gives a quick summary of what's going on, and may give hints of why things are not going well and what the future might hold.

- The Gain vs Loss Chart from the SSG.

The One page approach gives a quick overview, and makes anything else you might need to say more relevant and interesting. It can be projected on a screen, or printed and handed out. It takes some prep time, but not all that much once you get the hang of it.

The Lindatop

On Sat, Aug 15, 2020 at 9:51 AM Liz Peterson via bivio.com <user*21401800001@bivio.com> wrote:

You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?

Hello. For my club, I use a multipage powerpoint (PPT) as a PDF with screen captures of various datasources not only to better explain but also as a teachable moment. As a retired engineer, I had to communicate a lot using visuals to management and teams. An example is attached. This PDF is projected on a screen in a classroom we use at our Mill Race (Senior) Center monthly. My laptop is the 'driver' for these power points. We are also now using Zoom, remote microphone and camera for whiteboard discussions led by our best and most experienced investor partner. Personally I prefer pictures over prose, I agree can be boring, but probably because I have attention deficit s(ometimes). PPT presentation is few on words but I normally speak over each slide to explain them. I am also looking for a one page summary that is not intimidating to neophyte investors yet permits a good discussion of a stock. We also require a SSG using BI website online tool. However, compliance is sporadic. Comments please. Not saying this is superior to prose or first look, just an alternative (that works for me). I like an approach that reduces this to a one-page standardized format and will consider Linda's.

Thanks Norm

Norman C Blizard

SCS Investment Club Columbus IN

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of cecelia vanderlip via bivio.com

Sent: Monday, August 24, 2020 10:52 PM

To: club_cafe@bivio.com

Subject: Re: [club_cafe] Boring Stock Reports?

I like it!

On Aug 24, 2020, at 9:48 PM, Linda Glein via bivio.com <user*21345500001@bivio.com> wrote:

Does your club use visuals? Like using PPT on a screen or TV?

Even if you don't, you can hand out a quick report.

Here is what I do: (or used to, I got a bit out of the habit, but will start again).

<image.png>

I would grab (print screen these elements and include them on a one page summary.)

- The logo helps identify the company is a less boring way than just the name, so that is optional.

- The Sector & Industry, Quality Rating and Projected Return from ManifestInvesting.

- The Narrative from the ValueLine report. OR, the Narrative from the IAS report.

- The Visual Analysis from the SSG

- The SSG Results Summary from the SSG

- The Potential Gain vs Loss chart

Okay, why these elements, and why one page?

- The miniature Visual Analysis is something every BI member can immediately relate to and it tells a story.

- The ManifestInvesting notes give a similar, but independent perspective

- The SSG Summary quickly tells six pieces of important information

- the Potential Gain vs Loss chart is a quick visual that some people can better relate to than the U/D number that is in the Summary.

- The Narrative gives a quick summary of what's going on, and may give hints of why things are not going well and what the future might hold.

- The Gain vs Loss Chart from the SSG.

The One page approach gives a quick overview, and makes anything else you might need to say more relevant and interesting. It can be projected on a screen, or printed and handed out. It takes some prep time, but not all that much once you get the hang of it.

The Lindatop

On Sat, Aug 15, 2020 at 9:51 AM Liz Peterson via bivio.com <user*21401800001@bivio.com> wrote:

You know when you're listening to the stock reports during a club meeting and the reporter kind of drones on, and on, ... and on. It gets kind of hard to pay attention after 4 or 5 of those reports.

What do you think are the most important points to cover during a report? How do you talk about your stocks without sending all your members into a boredom coma?

What do you talk about most in a report about a stock you already hold, versus a potential new stock?