Hello. I hope this is an appropriate question for this forum. My club is transitioning from a ‘real’ investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member’s wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

Try finviz.com. I use it to track an annual contest our club runs. Just sign up and click on "portfolio" in the menu line to get started. It's free unless you choose a higher service level.

Each member could open a free Seeking Alpha account, set up multiple portfolios with number of shares, cost , date if purchase and other choices. Once portfolio is set up it will update itself. News articles will come to your email. Do not recommend sharing actual pages if you track your actual portfolio. Print page, scan and save file to share.Cindy GerkeTry finviz.com. I use it to track an annual contest our club runs. Just sign up and click on "portfolio" in the menu line to get started. It's free unless you choose a higher service level.

One other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

|

|

|

|

|

|

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

One other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

- Starting Amount: $1000.

- Starting price: Close of trade Dec. 31, or close of trade on day you make a mid-year trade.

- Close date: Close price on last day of the year.

- Trades: Max of one per quarter, cost of $50 to the portfolio

- Valuation: Close of last trade day for the month using Yahoo!Finance. Purchase price adjusted for splits and dividends. Secondary source is Quotemedia.

- You cannot gain an advantage by starting late. A $50 late fee and the current price OR the original price, whichever is worse.

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

We also have a contest every year. Members keep track however they want, we think everyone is honest. At the November meeting a winner is decided and they receive a prize from the last year's winner. The new winner decides on the rules for the next year. We have had a good time with this. Each year we start out with $10000 of imaginary money.One other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

- Starting Amount: $1000.

- Starting price: Close of trade Dec. 31, or close of trade on day you make a mid-year trade.

- Close date: Close price on last day of the year.

- Trades: Max of one per quarter, cost of $50 to the portfolio

- Valuation: Close of last trade day for the month using Yahoo!Finance. Purchase price adjusted for splits and dividends. Secondary source is Quotemedia.

- You cannot gain an advantage by starting late. A $50 late fee and the current price OR the original price, whichever is worse.

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

One other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

- Starting Amount: $1000.

- Starting price: Close of trade Dec. 31, or close of trade on day you make a mid-year trade.

- Close date: Close price on last day of the year.

- Trades: Max of one per quarter, cost of $50 to the portfolio

- Valuation: Close of last trade day for the month using Yahoo!Finance. Purchase price adjusted for splits and dividends. Secondary source is Quotemedia.

- You cannot gain an advantage by starting late. A $50 late fee and the current price OR the original price, whichever is worse.

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

Thank you,

Roy Chastain

"I am coming to be quite contented learning to do very little - slowly." Lionel Hardcastle [In "As Time Goes By"]

On Aug 22, 2021, at 7:10 AM, Peter Dunkelberger via bivio.com <user*26984900001@bivio.com> wrote:Why only one trade per quarter? Sounds like a real hoot, but I could get pretty edgy if I saw a pick dropping like a rock and had already made my trade for the quarter!Peter DunkelbergerOne other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

- Starting Amount: $1000.

- Starting price: Close of trade Dec. 31, or close of trade on day you make a mid-year trade.

- Close date: Close price on last day of the year.

- Trades: Max of one per quarter, cost of $50 to the portfolio

- Valuation: Close of last trade day for the month using Yahoo!Finance. Purchase price adjusted for splits and dividends. Secondary source is Quotemedia.

- You cannot gain an advantage by starting late. A $50 late fee and the current price OR the original price, whichever is worse.

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

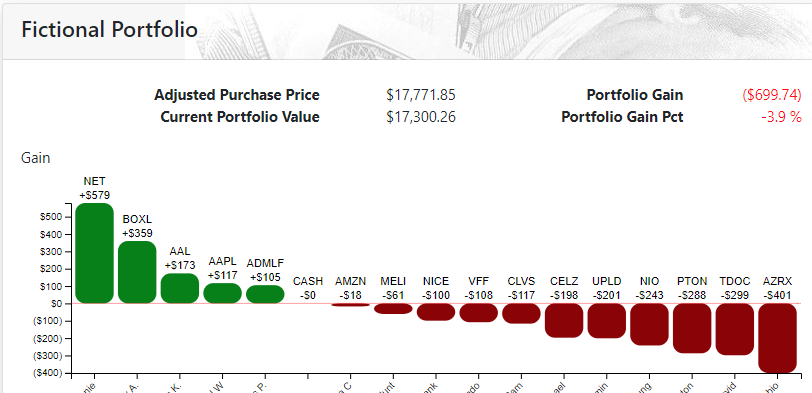

<image001.png>

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

Peter, I've followed this string and the process sounds interesting. Not being a member of the club I cannot speak for them. But, I like the one/quarter concept. Yes, I would hate it if one of my stocks falls (as happens to me in real life) but this requires the members to pick mostly rock solid stocks. When I buy after proper analysis and a stock drops, I reevaluate and often buy more. (Although when fundamentals look really bad I have sold, but rarely.) I think it might be just a way to ensure proper analysis. ???

Thank you,

Roy Chastain

"I am coming to be quite contented learning to do very little - slowly." Lionel Hardcastle [In "As Time Goes By"]On Aug 22, 2021, at 7:10 AM, Peter Dunkelberger via bivio.com <user*26984900001@bivio.com> wrote:Why only one trade per quarter? Sounds like a real hoot, but I could get pretty edgy if I saw a pick dropping like a rock and had already made my trade for the quarter!Peter DunkelbergerOne other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

- Starting Amount: $1000.

- Starting price: Close of trade Dec. 31, or close of trade on day you make a mid-year trade.

- Close date: Close price on last day of the year.

- Trades: Max of one per quarter, cost of $50 to the portfolio

- Valuation: Close of last trade day for the month using Yahoo!Finance. Purchase price adjusted for splits and dividends. Secondary source is Quotemedia.

- You cannot gain an advantage by starting late. A $50 late fee and the current price OR the original price, whichever is worse.

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

<image001.png>

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN

very true. Thanks for the input.PeterPeter, I've followed this string and the process sounds interesting. Not being a member of the club I cannot speak for them. But, I like the one/quarter concept. Yes, I would hate it if one of my stocks falls (as happens to me in real life) but this requires the members to pick mostly rock solid stocks. When I buy after proper analysis and a stock drops, I reevaluate and often buy more. (Although when fundamentals look really bad I have sold, but rarely.) I think it might be just a way to ensure proper analysis. ???

Thank you,

Roy Chastain

"I am coming to be quite contented learning to do very little - slowly." Lionel Hardcastle [In "As Time Goes By"]On Aug 22, 2021, at 7:10 AM, Peter Dunkelberger via bivio.com <user*26984900001@bivio.com> wrote:Why only one trade per quarter? Sounds like a real hoot, but I could get pretty edgy if I saw a pick dropping like a rock and had already made my trade for the quarter!Peter DunkelbergerOne other thing to consider is whether you are just tracking price appreciation, or if you want to track the overall appreciation that includes dividends. We used the Adj Close price in Yahoo!finance as a means of including splits and dividend. Similar to Bob, we tracked this with a spreadsheet that was updated monthly. We have now fully converted this over to an automated web page. Our rules for the fictional portfolio:

- Starting Amount: $1000.

- Starting price: Close of trade Dec. 31, or close of trade on day you make a mid-year trade.

- Close date: Close price on last day of the year.

- Trades: Max of one per quarter, cost of $50 to the portfolio

- Valuation: Close of last trade day for the month using Yahoo!Finance. Purchase price adjusted for splits and dividends. Secondary source is Quotemedia.

- You cannot gain an advantage by starting late. A $50 late fee and the current price OR the original price, whichever is worse.

The last rule was from members not getting their selections in before the start of the year. We only apply this if there is a material difference. Should also add that we track fractional shares, and allow members to hold CASH if they desire.

The club has a silver piggy bank we purchased 20+ years ago. Each year, we engrave the winners name on the bank and they hold the prize for the year until we have a new winner and "the pig" changes hands. The loser gets a nice framed "Haven't Got a Clue" award.

<image001.png>

Jimmy

James P. Dickerson

From: club_cafe@bivio.com <club_cafe@bivio.com> On Behalf Of Bob Mann via bivio.com

Sent: Tuesday, August 17, 2021 10:27 AM

To: club_cafe@bivio.com; Norman C. Blizard via bivio.com <user*36041900001@bivio.com>

Subject: Re: [club_cafe] Tools to track virtual or mock (shadow) portfolios

Use Google docs. Here's the one I created for Southeast Michigan BI chapter to do our portfolio competition: https://docs.google.com/spreadsheets/d/1PDUQJC9FP9ZJSSK94zUx4A5yd4pNvSNl4oWYbn9Ecs0/edit?usp=sharing

email me privately at sailrmann at comcast dot net if you have questions.

Bob Mann

On 08/17/2021 10:17 AM Norman C. Blizard via bivio.com <user*36041900001@bivio.com> wrote:

Hello. I hope this is an appropriate question for this forum. My club is transitioning from a 'real' investment club to a virtual investment class where each member tracks his/her own virtual portfolio. Starting with an initial investment of $10K each, class members will virtually buy, sell or hold stocks in their portfolio. After 1 year we will reward the winners (and losers) with kudos but no real capital gains or losses. Question is what are the tools or websites out there that can help us set up and track mock portfolios? Class members are encouraged to have their own real personal investing portfolios, but because of differences in member's wealth and investing savvy, we wanted to run the class on a level playing field with the mock portfolios. Any suggestions?

Thanks

Norm C Blizard

MRC Investment Class

Columbus IN