K-1/K-3

Does anybody have an answer for one of our partners who is trying to do her taxes?

---------- Forwarded message ---------

From: Valarie <>

Date: Sat, Mar 5, 2022 at 10:27 AM

Subject: Fw: K-1/K-3

To: John <>

From: Valarie <>

Date: Sat, Mar 5, 2022 at 10:27 AM

Subject: Fw: K-1/K-3

To: John <>

Hello again!

I seemed to have fixed the box 13 W* (7) issue by not listing it as a W code but entering it later in the "other deductions" for box 13 entry. I still have not listed the K-3 amount anywhere, but my software program doesn't see any errors even with listing

that I had a K-3. Do you know where the K-3 amount should be listed on the IRS form?

Thanks for all you do to keep our stock club progressing!

Valarie

Sent from Outlook

From: Valarie

Sent: Friday, March 4, 2022 10:17 PM

To: John Rice

Subject: K-1/K-3

Sent: Friday, March 4, 2022 10:17 PM

To: John Rice

Subject: K-1/K-3

Hi John,

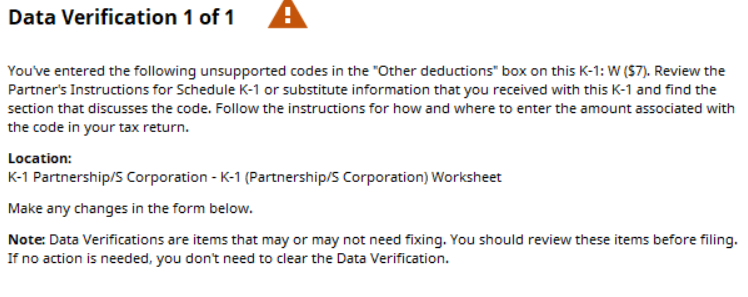

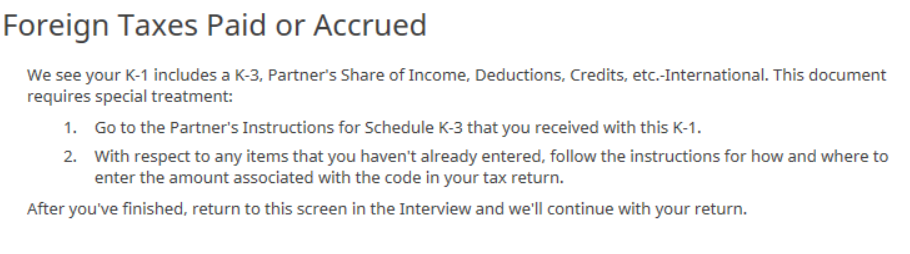

I'm trying to figure out how to report the Box 13 W* (7) and K-3 (3.58) amounts in my H&R Block tax program. The program flagged the W code with the notice below which says it may or may not need to be fixed. I also didn't see anywhere to report the K-3 amount

- maybe I don't even need to. I'll include what the program says about the K-3 below as well. Do you have any suggestions? Thanks! Valarie

Sent from Outlook

Schedule K-3 is only needed if someone needs to complete Form 1116, Foreign Tax Credit.. Most taxpayers can claim their foreign tax credit directly on Schedule 3, line 1 without having to complete Form 1116.

Ira Smilovitz

Does anybody have an answer for one of our partners who is trying to do her taxes?---------- Forwarded message ---------

From: Valarie <>

Date: Sat, Mar 5, 2022 at 10:27 AM

Subject: Fw: K-1/K-3

To: John <>

Hello again!

I seemed to have fixed the box 13 W* (7) issue by not listing it as a W code but entering it later in the "other deductions" for box 13 entry. I still have not listed the K-3 amount anywhere, but my software program doesn't see any errors even with listing that I had a K-3. Do you know where the K-3 amount should be listed on the IRS form?

Thanks for all you do to keep our stock club progressing!

Valarie

Sent from Outlook

From: Valarie

Sent: Friday, March 4, 2022 10:17 PM

To: John Rice

Subject: K-1/K-3Hi John,

I'm trying to figure out how to report the Box 13 W* (7) and K-3 (3.58) amounts in my H&R Block tax program. The program flagged the W code with the notice below which says it may or may not need to be fixed. I also didn't see anywhere to report the K-3 amount - maybe I don't even need to. I'll include what the program says about the K-3 below as well. Do you have any suggestions? Thanks! Valarie

Sent from Outlook