There are rules for what companies can report in the "Dividend" tax category.

There are times when a company closes its books for the year that it needs to "Reclassify" some of it's distributions as something other than dividends. Dividends can be reclassified into 2 to 5 different categories depending on the type of investment.

You'll know this has happened because you will see the reclassification categories on your 1099. This means you will need to adjust your bivio records to report your taxes correctly.

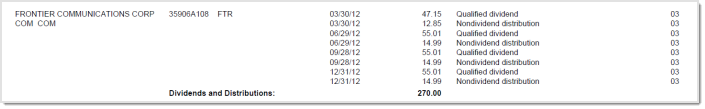

On your 1099 you may see something like this:

Or, you may find the amounts assigned to the different categories reported in separate sections of your 1099.

In this example, a portion of the distributions this club received from Frontier have been re-classified as a Return of Capital or "Non-dividend" distribution.

When you see this or other reclassifications on your 1099's, you need to make changes to your bivio records before you can file your taxes. Here's how:

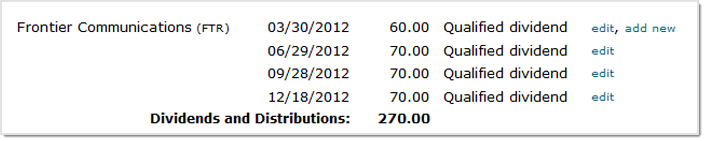

First, you need to find the stock in question on the bivio 1099 DIV review report.

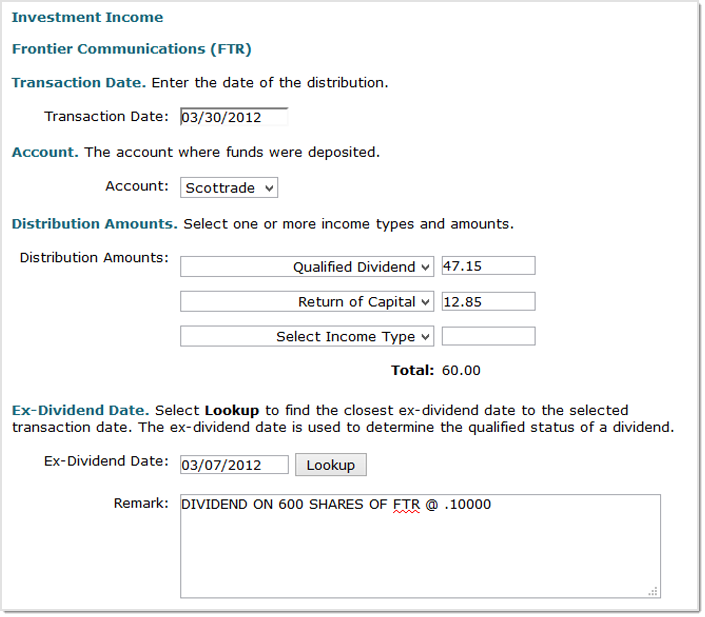

To adjust for the reclassifications select the edit link next to one of the dividends.

This opens the dividend entry form. On it you can split the entry into each of the components shown on the 1099. In this case, there will be two categories, one for the dividend portion ($47.15) and one for the return of capital ($12.85).

The total of the two will still be the same as the original "dividend" amount.

The return of capital entry is very important. Even though that income is not taxable to you during the current year, it does affect the cost basis of your shares. If you don't make the entries, you will overpay on your taxes during the current year and your cost basis will not be correct when you sell your shares.

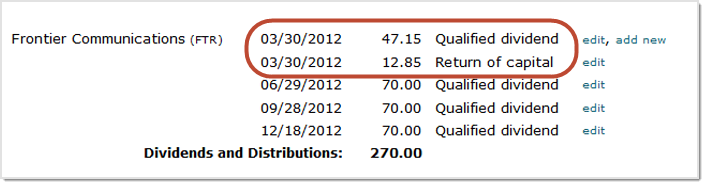

When you return to the 1099 DIV review page, you will see two entries for the distribution rather than one. You should continue to make adjustments for each dividend received until all the changes have been made in bivio.

Related help topics:

- About 1099's

- Handling Dividends During Tax Preparation

- Income Categories

- Preparing Your Investment Club Taxes

- Qualified Dividends

- REIT's

More questions? More Help